A still complicated environment

The French economy is likely to remain sluggish in 2023, with GDP growth of just +0.7% for the year (Banque de France forecast).

Withinflation slowing, and the spectre of certain shortages receding, the economic situation should nevertheless improve for certain sectors, notably the tourism sector, buoyed by the summer vacations (excluding any impact of the recent riots on foreign tourist numbers). However, many companies are not benefiting from this lull and remain on a tightrope, due to a lack of cash or sufficiently full order books, as in the Building sector, and/or because of the more stringent household trade-offs that are having a direct impact on retail companies.

Added to this are the consequences of the recent riots. We will need to keep a close eye on the situation of the 2,150 professional properties affected, particularly tobacco and food outlets, which were among the hardest hit.

"At the end of June 2023, over a sliding 12-month period, and in particular over the second quarter of the year, the increase in the number of business failures (opening of receivership and direct judicial liquidation proceedings) is weakening, +44% in mainland France, and +24% in the French overseas departments and territories.""

- Max Jammot, Business Unit Manager at Ellisphere

Slower increase in the number of insolvency proceedings over the 1st half of 2023

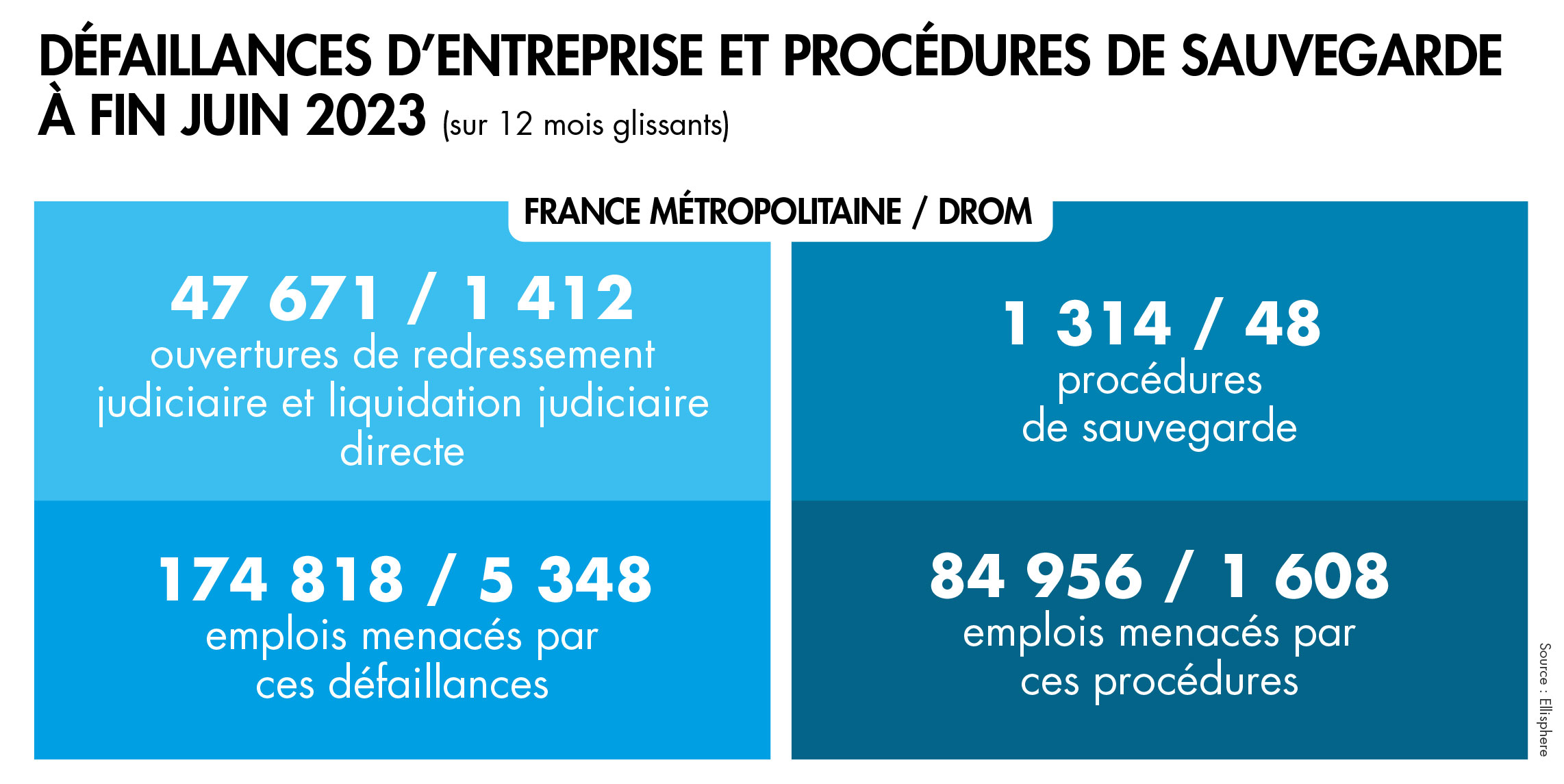

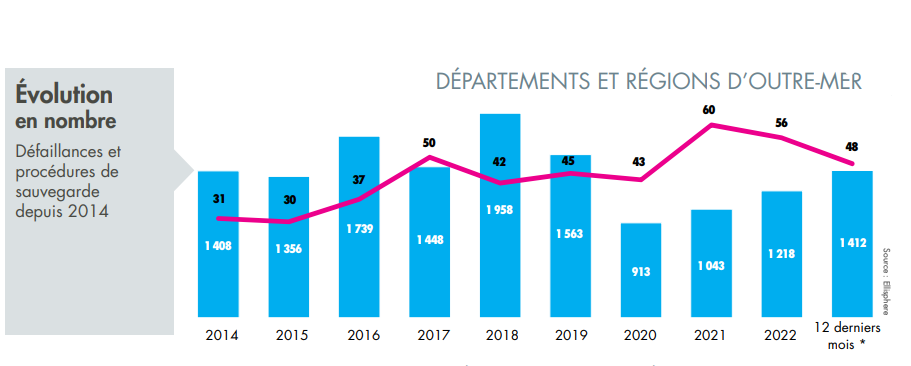

Over a sliding 12-month period to the end of June 2023, insolvencies in mainland France totalled almost 47,670 (including the opening of receivership and direct liquidation procedures), an increase of +44% year-on-year. This represents a smaller increase than at the end of March 2023, when the figure was almost +50%. On the safeguard side, with more than 1,300 procedures opened, the increase remains strong but significantly contained, with "only" +56.6% at the end of June 2023. Between January and June 2023, the number of receivership, direct judicial liquidation and safeguard procedures opened reached 27,762 entities, an increase of +36.9% compared to the first half of 2022. For the record, in the first quarter of 2023, the increase was much higher, at +42.3%.

Retail and food sectors in difficulty

At the end of June 2023, over a sliding 12-month period, the Building & Public Works (BTP) sector still accounted for a quarter of all business failures in mainland France, followed by the Personal Services sector (19% of failures) and the Business Services sector (10% of failures). Over the past year, the Agri-food sector has continued to suffer, with the highest increase in the number of business failures: +76%, particularly in the Bakery-Pastry segment. The Consumer Services and Household Appliances sectors, hit by consumer trade-offs, recorded an increase in the number of insolvencies of over 60%. The number of insolvencies in the Textile-Clothing-Leather, Retail and Consumer Goods sectors rose by over 50%.

Occitanie most affected over the year

In terms of business failures, the Ile-de-France, Auvergne-Rhône-Alpes, PACA and Occitanie regions account for 54.3% of procedures in mainland France. The same regions account for the same percentage of safeguard procedures, with the exception of Occitanie, which is replaced by Nouvelle-Aquitaine.

It should be noted that over the last 12 months to the end of June 2023, Occitanie recorded one of the highest increases in mainland France for both insolvencies (+57%) and safeguard procedures (+60%). Recourse to safeguard procedures has also doubled in the Ile-de-France and Auvergne-Rhône-Alpes regions, where the population of SMEs and ETIs is denser and more heavily impacted. Last but not least, we should mention Corsica, where the number of insolvencies almost doubled, while the number of sauvegardes tripled.

Focus on the departments and regions d'Outre-Mer

In the French Overseas Departments and Regions (DROM), the number of receiverships and direct judicial liquidations is approaching the pre-crisis Covid-19 level, with 1,412 openings over one year to end June 2023. The increase remains lower than in mainland France, at +24%. On the safeguard side, while the number of entities concerned is higher than in 2019, with 48 procedures recorded, the decline that began in 2022 is confirmed, with a -26% drop over the last 12 months to end June 2023. Geographically, Réunion remains the hardest hit, with around +50% in the number of business failures and safeguard procedures at the end of June 2023 over a sliding 12-month period. Martinique accounted for a quarter of all insolvencies recorded in the DROMs at the end of June 2023, and Guadeloupe for a quarter of all safeguard procedures. Over the last 12 months, the biggest increase has been in Mayotte, hit by a major social crisis, where the number of business failures has multiplied by 3. In French Guiana, the number of receiverships and liquidations rose by +49%, while the number of safeguard procedures increased by a factor of 2.5. In terms of business sectors, the construction and public works sector accounts for a third of insolvencies and a quarter of safeguard procedures in the French overseas departments and territories. In these regions, a sharp rise in the number of receiverships and direct judicial liquidations (+73%) was seen in personal and community services (+62%).

Download our complete study now.

Every month, our business unit deciphers the latest news on the entrepreneurial dynamic in mainland France and the French overseas departments and territories, and shares its findings with you.