At the end of March 2022, over a sliding 12-month period in metropolitan France, there were 29,501 receiverships and direct judicial liquidations, as well as 713 safeguard procedures. These insolvencies and safeguard procedures threatened no less than 83,029 and 26,572 jobs respectively.

A deteriorated economic context at the end of the first quarter

With the Covid-19 crisis and the recent events in Ukraine, economic indicators are slowly but surely deteriorating. The latest projections of the Banque de France put French GDP growth between 2.8 and 3.4% after the 7% catch-up effect in 2021. Industrial production, which declined in February 2022, is still below the 2019 level of around 4%. Concerns also come from household consumption, while in March 2022 consumer prices increase by 4.5% on an annual basis according to Insee, a record since 1985.

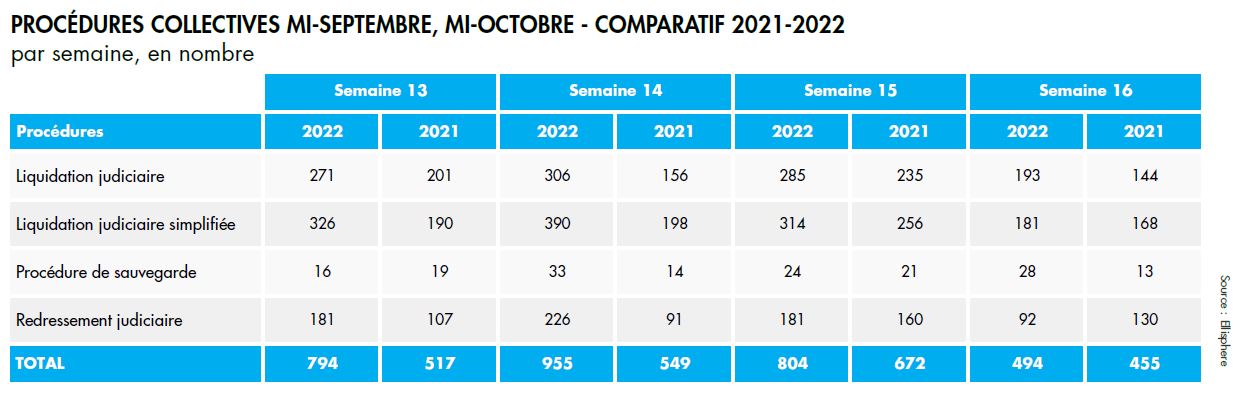

The rise in energy prices, particularly oil and gas, is weighing more heavily on constrained spending, both for individuals, impacting their purchasing power, and for companies, whose profitability is being eroded. With the reduction in social, tax and financial aid measures granted to companies at the height of the Covid-19 crisis, as well as a return to normal activity in the court registries, the number of insolvencies (receiverships and direct judicial liquidations) is clearly increasing in metropolitan France - a trend that has been underway since December 2021.

Increase in insolvencies over 12 months and in Q1 2022

Over the last 12 months to the end of March 2022, the increase is 7.2% compared to the same period in 2020-2021. After having reached a low point in 2021 of 27,000 insolvency proceedings opened with the court registries, the number of insolvencies has thus started to rise again, reaching 29,500 judgments at the end of March 2022 over a sliding 12-month period. This trend is also accompanied by an increase in the number of jobs at risk, with 83,000 positions affected compared with 78,500 at the end of 2021.

The impact of the gradual easing of state support for businesses began to be felt from December 2021; it was confirmed in the first quarter of 2022. Although the number of insolvencies in the first quarter is still one-third lower than in 2019, it is 34% higher than in 2021. The type of business that fails remains the same. Nearly 91% of them are very small businesses, and 83.4% are commercial companies. More than 30% of businesses are between 5 and 10 years old. However, businesses under 5 years old have been largely affected by the last two years of crisis, and in particular by the fact that those less than three years old have been unable to access aid such as State Guaranteed Loans (SGL).

"After two years at their lowest level, business failures have thus, unsurprisingly, increased at the beginning of 2022; an increase in the number of collective procedures that is returning to a certain normalization of the economy. The end of subsidies, the surge in energy pricesThe end of subsidies and the surge in energy prices are all factors that have contributed to this resurgence in insolvencies.

- Max Jammot, Head of the Economic Division at Ellisphere

Clear rebounds in insolvency proceedings at the end of the first quarter for all sectors

In terms of business sectors, most of the sectors studied (18 out of 22) are now recording an increase in the number of insolvencies. At the end of March 2022, the top three sectors remained unchanged: construction and public works, personal services and business services, which accounted for more than 53% of new business start-ups over the past 12 months, with construction alone accounting for more than a quarter. Some sectors of activity are clearly struggling more than others, with increases of more than 20% over one year. This is the case for Means of Transport (+21%), where manufacturers, subcontractors and retailers of transport vehicles such as cars are going through an unprecedented storm, with a combination of price increases for upstream supplies and sluggish downstream consumption. Thus, in March 2022, new car sales in France were historically low, while the used car market, which was still resisting, is also in decline.

Another current victim of the crisis is the IT and electronics sector, where the number of insolvencies has risen by 22%, and which is at the center of the turbulence affecting the electronic components market. The industrial equipment sector (up 23% in the number of insolvencies) is suffering the most from the reluctance to invest in industry, whose financial leeway has been reduced by the crisis.

In the current economic context and with the increase in the number of receiverships and direct judicial liquidations, it is surprising that the preventive procedure of safeguard is still used so little. With 713 openings over the last 12 months to the end of March 2022, the use of this procedure is down by 4.2%. Could this be due to the numerous deferrals of tax and social security charges, which have kept potential short-term difficulties at bay? And/or the impact of the State Guaranteed Loans, which provide companies with a little liquidity while waiting for the first repayment dates of the new debts contracted...?

In fact, recourse to the safeguard procedure often affects larger companies: 29.5% of SMEs and ETIs compared to 9.3% for direct receiverships (RJ) and liquidations (LJ). This procedure also concerns older companies: 51% more than 10 years old against 38.2% for receivership/legal liquidation, and still essentially commercial companies 84.7% of the entities concerned.