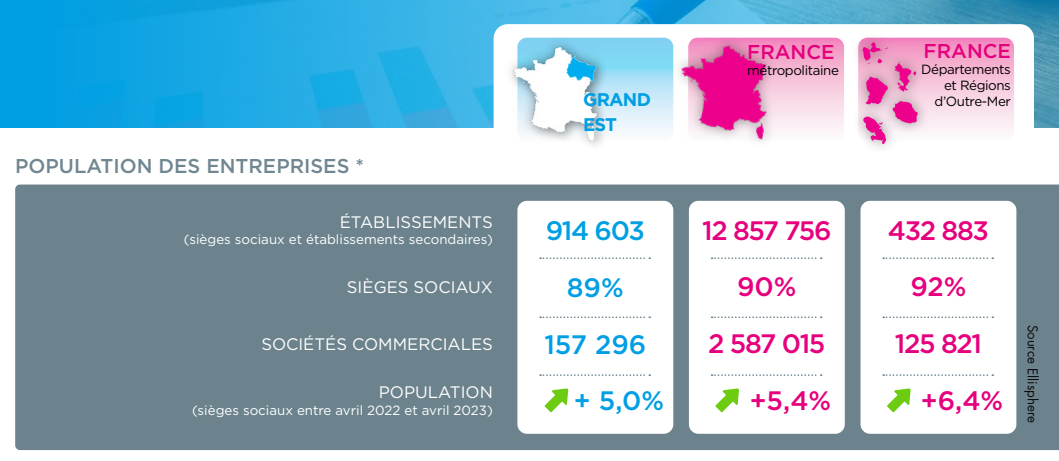

Entrepreneurial momentum holding steady in the Grand Est region

Grand Est, a region on the move, boasts an entrepreneurial dynamism index (IDE*) of 1.6, higher than the national index (1.5); however, there are major disparities between the departments making up the region.

The Alsatian départements of Bas-Rhin and Haut-Rhin, with their highly diversified, internationally-oriented economies, boast a very favorable FDI of 1.7 and 1.6 respectively, while the Meuse département, with its more agricultural vocation, has an entrepreneurial dynamism index of 1.4, lower than the national index. Meurthe et Moselle, on the other hand, recorded an EDI of 1.2, due to a very sharp rise in the number of business disappearances (+35% of entities disappeared by the end of 2022 over a sliding 12-month period), setting it apart from the other départements in the Grand Est region.

In the Grand Est region, direct judicial liquidations accounted for 6.8% of all business closures, one point higher than the national figure.

The Haut-Rhin département is the region's top performer, with a 7% share of judicial liquidations. In France, over 90% of receiverships end in liquidation. There is a high level of business insolvency in the industrial sector, which has a significant impact on employment.

Micro-businesses at the heart of the business creation machine

In the Grand Est region, as in France as a whole, entrepreneurial dynamism is essentially driven by the success of the micro-business, which accounts for 61% of new business start-ups. This status is widely favored, as it offers highly advantageous micro-social and micro-tax regimes, taking precedence over the sole proprietorship. For example, in the Haut-Rhin département, 69% of business start-ups will be self-entrepreneurs by the end of 2022, compared with 41% in 2019; 16% will be companies, compared with 31% in 2019; and 15% will be sole proprietorships, compared with 28% in 2019. These figures reflect the fact that the under-30s in particular are adapting to an increasingly changing economic environment and job market, with microenterprises often providing an agile response to employment or income supplementation issues.

Financial debt and corporate insolvency

The financial indebtedness of French companies has been on the rise since 2020, and the uncertainty surrounding the repayment of annual debt servicing has risen following the end of the "whatever it takes" measures deployed by the French government. There is a strong causal link between the rise in financial indebtedness and insolvencies, with the permanent threat of non-repayment of debt... As with other financial commitments, State Guaranteed Loans can be affected. In the finance departments of BtoB companies, this causal link should lead to the implementation of a specific debt indicator (rating), in order to better analyze customer and supplier portfolios.

This indicator must be able to measure repayment capacity (net debt/equity ratio), net financial debt ratio (gearing) and the balance between annual servicing of financial debt and cash generated by operations. In the vast majority of cases, companies that have been the subject of insolvency proceedings have a very unfavorable debt rating. The fragility of a company's financial structure needs to be detected at an early stage, before the risk of illiquidity deteriorates. It is not unusual to see liquidity ratios in excess of 1 in the 2022 financial statements. If the debt rating is unfavorable, it is likely that these liquidity ratios will not remain at their previous level in 2023/2024, as they will deteriorate very rapidly.

*IDE - Indice de Dynamisme Entrepreneurial (Entrepreneurial Dynamism Index) is the ratio between the number of business start-ups and the number of business closures, all types combined.

Download our complete study now.

Every month, our business unit deciphers the latest news on the entrepreneurial dynamic in mainland France and the French overseas departments and territories, and shares its findings with you.