New clouds on the horizon

In addition to the economic difficulties already observed, the banking sector is now experiencing a number of upheavals, as illustrated by the rise in key interest rates, with the risk of a tightening of credit conditions for both individuals and professionals.

For individuals, these increases are already having an impact, with a significant drop in real estate and consumer credit. For companies, the rise in interest rates could eventually weigh on the debt burden and investment.

Another point of concern is the low level of growth to come in a context of inflation according to the IMF, which only expects 2.8% growth in world GDP in 2023.

Insolvencies double over one year, reaching the level of the last quarter of 2019

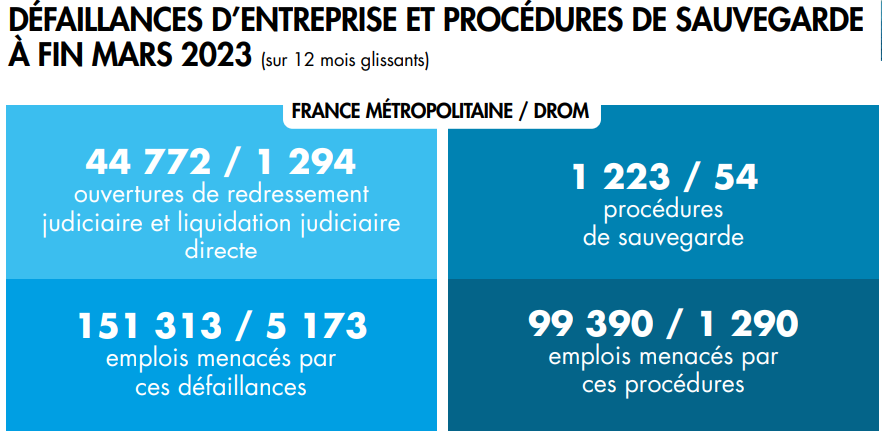

At the end of March 2023, over a sliding 12-month period, the number of insolvencies in metropolitan France (openings of receivership and direct judicial liquidation) rose by 50.4% to nearly 44,800 procedures.

Compared to 2019, the full-year differential is now only 5,300 procedures (-10.5%). Over the first quarter of 2023, the cumulative number of procedures is now at the same level, approximately 14,100.

For safeguards, the ceilings have already been exceeded. With more than 1,200 procedures opened over the last 12 months, i.e. +58% over one year, we are back to the 2017 level.

No sector spared

All sectors of activity have been affected by this increase in insolvencies. Over the last 12 months, 53.6% of insolvencies have been in the construction, personal and business services sectors. The food sector is also suffering, with a 96% increase in the number of insolvencies, particularly for bakeries (up 104%), due to the soaring price of raw materials, packaging and energy.

Among the other sectors of activity affected, with an increase of more than 70%, are Consumer Services and more specifically Tourism companies (+86.4% of insolvencies), particularly in the restaurant sector, whether traditional or fast food. Next come financial services and household goods. The latter two sectors have been caught up in household consumption decisions and the tightening of credit conditions.

Metropolitan regions heavily impacted

In the regions, 55.1% of insolvencies are concentrated in Ile-de-France, Auvergne-Rhône-Alpes, PACA and Occitanie.

In the case of safeguards, 51.8% of judgments were recorded in Auvergne-Rhône-Alpes, Ile-de-France, New Aquitaine and PACA.

Significant changes have occurred in certain regions. The number of receiverships and liquidations has increased by more than 60% in Occitania, Hauts-de-France, Brittany and Centre-Val-de-Loire. In these regions, business failures are particularly heavy in restaurants and cafés, bakeries and construction.

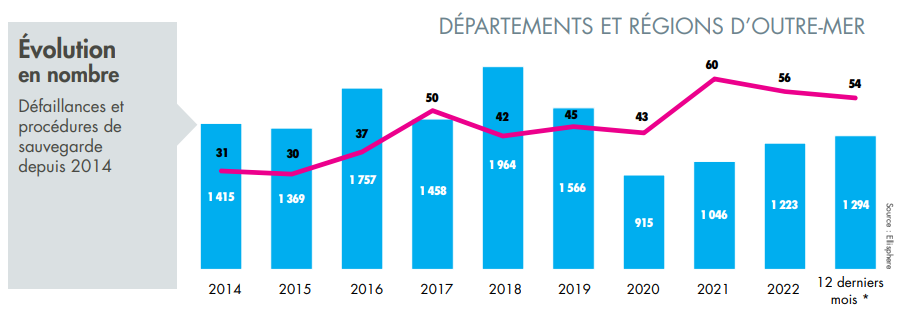

More favorable trends in the DROMs

In the French Overseas Departments and Regions, insolvency proceedings are developing differently. The number of receivership and liquidation proceedings has been rising since 2021, reaching just under 1,300 entities at the end of March 2023.

However, the change remains limited to +17% over the last 12 months and remains at -17% of the 2019 level. For now, overQ1 2023, the number of insolvencies is at -15.2% ofQ1 2019.

On the other hand, the trend for backups has been decreasing since 2022, but we are still at a higher level than in 2019 (+25.6%).

"All sectors of activity are affected by the rise in the number of insolvencies in mainland France. The situation is identical on a global scale, although three sectors are more represented than others: distribution, construction and services, which have been hard hit by the inflationary context. "

- Max Jammot, Head of the Economic Research Department at Ellisphere

Download our complete study now.

Every month, our economic division decrypts the news of the economic sectors and gives you its lessons.