2022, end of the truce

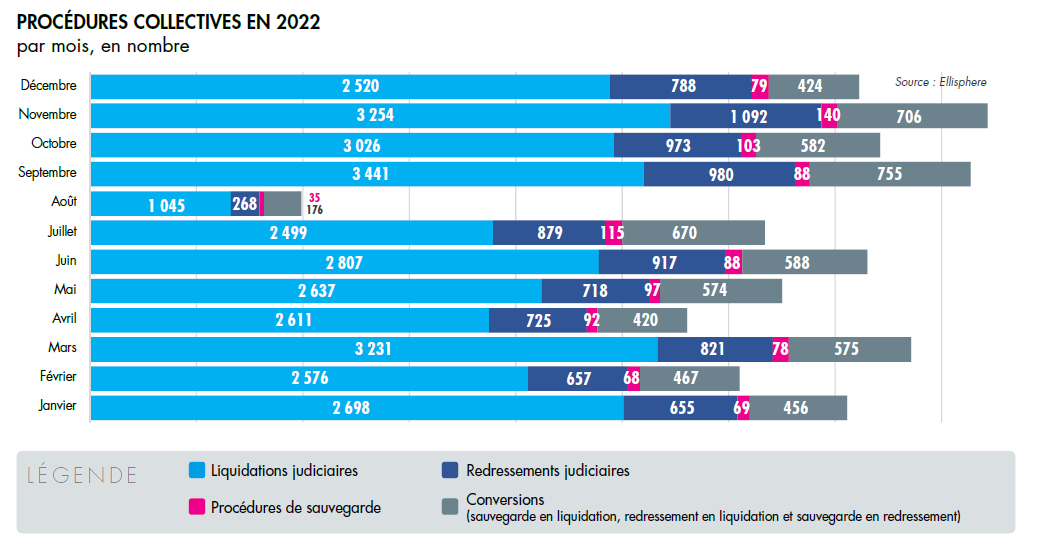

In 2022, in Metropolitan France, 41,700 openings of receivership, direct judicial liquidation, safeguard procedures and crisis exit procedures will be recorded, i.e. an increase of 49.2% compared to 2021. If we add the procedures recorded in the Overseas Departments, we peak at nearly 43,000 in 2022, i.e. an increase of 47.9% over one year. Nevertheless, this figure is still lower than in 2019, which was 52,600 collective proceedings.

For backups, which are up 52.4% in 2022, the levels achieved are now higher than in 2018.

After suffering the Covid-19 crisis in 2020-2021, the effects of the war in Ukraine (rising energy and commodity prices) in 2022, French companies are now entering the hard times, with the repayment of State Guaranteed Loans (SGL) in particular. While the wave of defaults still appears to be contained, the wall of debt is now facing a large number of players weakened by three difficult years. Fiscal year 2023 looks even riskier, with an upward trend expected to continue, approaching the level of insolvency proceedings in 2019.

Two sectors particularly affected: personal services and agri-food

In metropolitan France in 2022, three sectors will account for the majority of business insolvencies (receivership and direct judicial liquidation): construction and public works, personal services and business services, which together will account for 53.5% of all insolvencies.

The food processing sector (+99% of insolvencies) has been hit hard by the explosion in the price of raw materials and energy. This sector is very energy-intensive, both for cooking and for refrigerating products.

Services to individuals (+91% of bankruptcies) have also suffered from household consumption choices in a context of high inflation and falling disposable incomes. The sector was particularly affected in its tourism component, and in particular in the restaurant sector, whether traditional or fast food. For these businesses, the number of bankruptcies has more than doubled over the past year. The same was true of their colleagues in the drinks sector, with a 94% increase in insolvencies.

Still in personal services, the increase in the number of bankruptcies was also recorded for beauty care (+104%) and hairdressers (+78%). These are two businesses that, after having been largely impacted by imposed closures and confinements, cannot cope with the repayment of their debts and the increase in fixed costs.

SMEs and other recently created structures, weakened by the impacts of the pandemic and then by the consequences of the Russian-Ukrainian conflict, are clearly the most threatened by the energy crisis, which is expected to continue to rage in an economic context that will probably remain difficult.

- Max Jammot, Head of the Economic Division at Ellisphere

Focus on the main sectors of activity

The major imbalances generated by the health crisis have triggered an inflationary mechanism, strongly accentuated by the impacts of the Russian-Ukrainian conflict.

In France, in 2022, among the sectors most impacted, the Building and Public Works (BTP) sector was strongly affected by the rise in raw material prices. Indeed, the overall cost of materials rose by +18% in the first quarter of 2022, with an average of +19% over the year for the price of cement, +15.7% for wood and +60% for aluminum.

The Agribusiness sector, is facing the explosion of costs. For example, food prices, which have been rising since January 2021, increased by an average of 10% in September 2022 to reach 12% in December

2022.

For its part, the situation of crop production has improved (+3.1% vs. -0.1% in 2021). The rebound in wine (+30.9%) and fruit production (+21.8%) after a mediocre year in 2021, has offset the declines in cereal (-10.9%) and potato (-9.2%) harvests, linked to drought episodes. Animal production volumes were down by 3.4%.

As for the bakers, they have found themselves in trouble, mainly due to the explosion in the price of raw materials and energy. Redundancies or even closures, many threats are hanging over the profession whose margins can no longer absorb energy bills that have been multiplied, for some, at least by 8 or 10.

After a buoyant period in the second half of 2021 and the first quarter of 2022, demand for metals and steel slowed. In contrast, demand for aircraft construction remained robust, primarily benefiting aluminum producers and wholesalers.

In the Commercial Aviation sector, order books were significant, with several years of production guaranteed, despite labor shortages and tensions over the supply of certain raw materials and electronic components.

The Hauts-De-France, Brittany and Occitania regions strongly impacted

Unsurprisingly, in 2022, the top three economic regions in metropolitan France will account for a large proportion of receivership and direct judicial liquidation procedures, i.e. 45.4% for Île de France, Auvergne-Rhône-Alpes and PACA. Together with Occitania, these four regions account for 54.6% of business failures in mainland France.

What is the situation for the Overseas Departments and Regions?

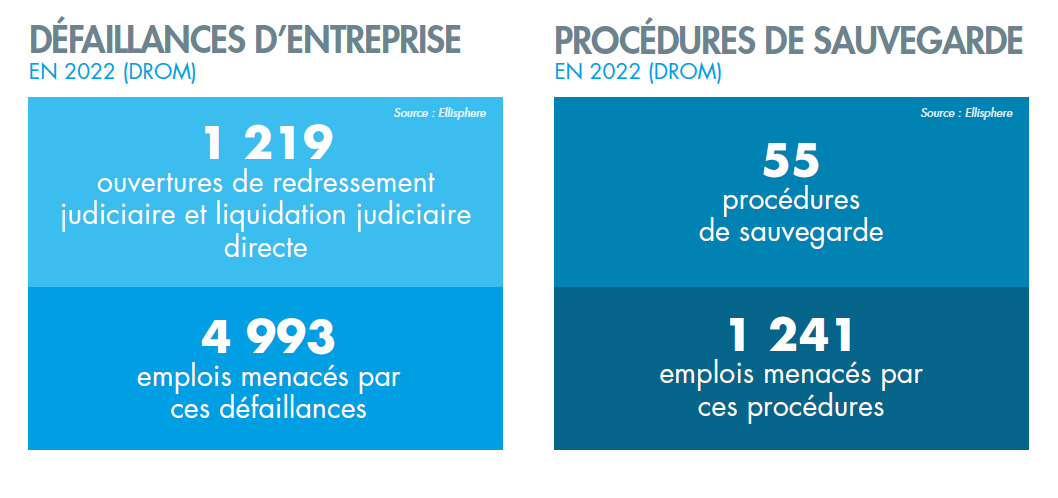

In 2022 in the French Overseas Departments and Regions (DROM), the number of business failures (openings of receivership and direct judicial liquidation) increased more moderately than in mainland France, with +16.3%. And this, even if this increase had begun in 2021.

Moreover, unlike in metropolitan France, the number of safeguard procedures fell by 8.3% in 2022. It is true that in these departments, large companies, more likely to opt for this preventive measure, remain rare.

Download now our complete study.

Every month, our economic division decrypts the news of the economic sectors and gives you its lessons.