A sector under strong tension

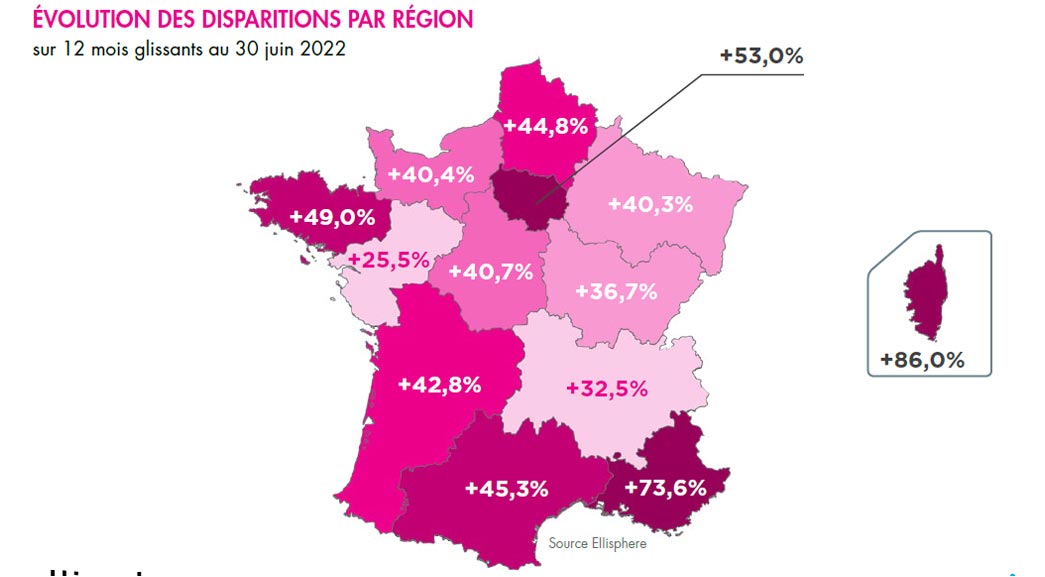

The Russian-Ukrainian conflict has shaken up markets that were already under pressure. Energy, which is unaffordable, has given a strong boost to inflation. All the building and public works (BTP) trades were globally impacted by increased demand, insufficient production, an explosion in the price of raw materials and a rise in production costs.

The situation in the building and public works sector has become worrying: postponements, cancellations of work by private individuals or late penalties applied to public contracts. Metals, wood, rubber... The costs of these basic materials are constantly on the rise. Some raw materials are sometimes unavailable in the short term, thus having a lasting impact on all ongoing projects.

Steel prices have risen by 50% since the beginning of 2021, polymer prices are soaring and timber prices have tripled in the last twelve months.

In this difficult context, the construction industry's crisis cells have been reactivated in the départements, bringing together, under the aegis of the prefects, all the players in the sector. The aim is to discuss the issues at stake locally and to try to resolve them. SMEs in the public works sector, which have been particularly hard hit by the rise in the price of non-road diesel, are receiving specific assistance (a total of €80 million, paid in one go, in proportion to the turnover of eligible companies).

A regulatory environment that generates additional costs

In Construction, between May 2021 and April 2022, more than 500,000 new homes were authorized, according to the Ministry of Ecological Transition, a level higher than 2019. This sudden influx of building permits is in line with the entry into force, on January 1, 2022, of more restrictive thermal and environmental standards known as "RE2020" applicable to new construction.

These standards require new housing to be better insulated against cold and heat, thus limiting their environmental impact, with an additional cost of 7 to 8%. Another provision also impacts authorizations: the objective of zero net artificialization (ZAN) to reduce the nibbling of natural spaces compared to the 2012-2021 period; a measure that is more favorable to collective housing than to individual constructions.

The anticipation of these measures, if it temporarily inflates the number of building permits, will ultimately result in building permits that are more difficult to obtain and in additional financial costs for construction. These consequences will make it more difficult to obtain building permits and will increase the financial cost of construction. This will have a chilling effect on new buyers, particularly first-time buyers, for whom access to credit and rising interest rates are already a barrier.

Indeed, on January1, 2022, new conditions for granting credit to households will apply in order to reduce the risk of overindebtedness. The effort rate will no longer be able to exceed 35% of income and the repayment period for real estate loans will be limited to 25 years.

"Despite the difficulties of supply and recruitment that remain significant, the sector's activity is showing its dynamism with a high level of order books. Nevertheless, many players, including the Fédération Française du Bâtiment, have expressed concern that new housing could decline sharply by the end of the year. "

- Max Jammot, Head of the Economic Division at Ellisphere

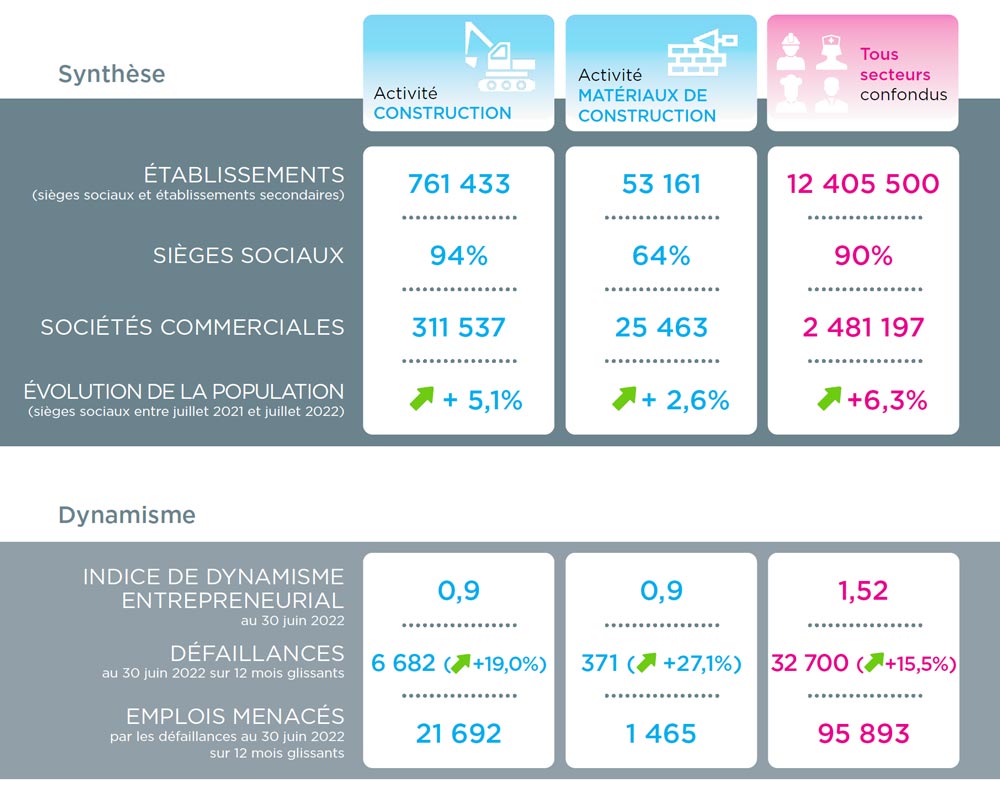

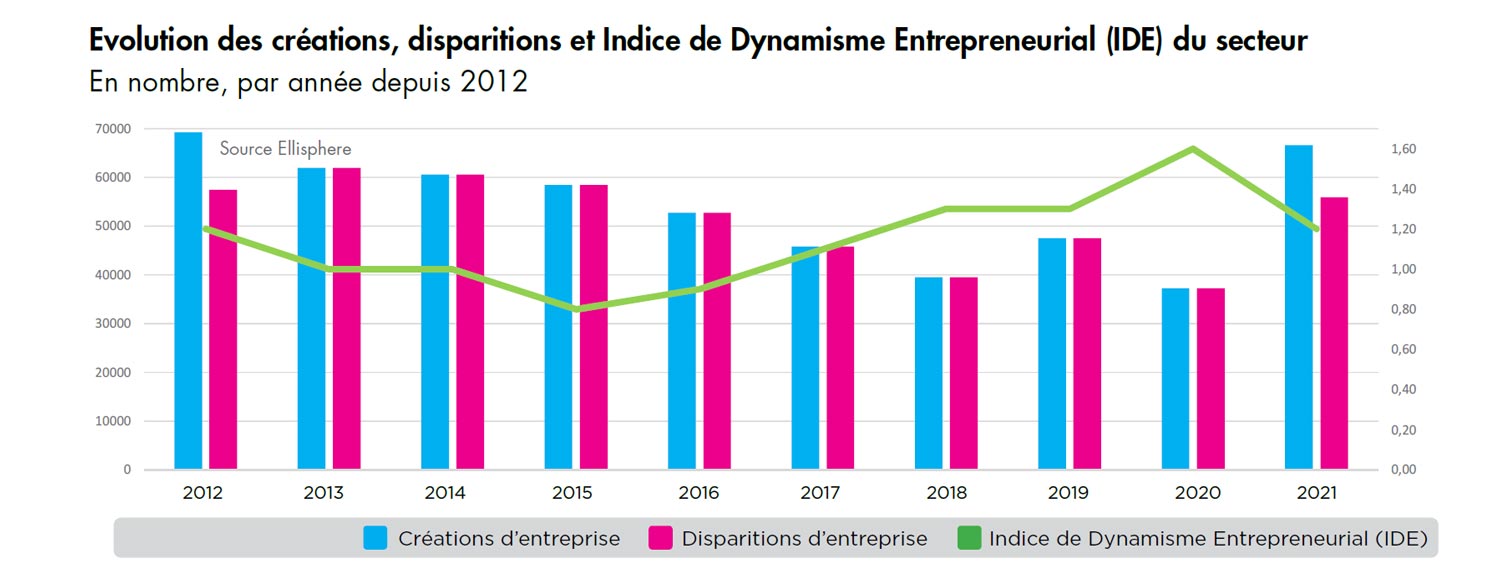

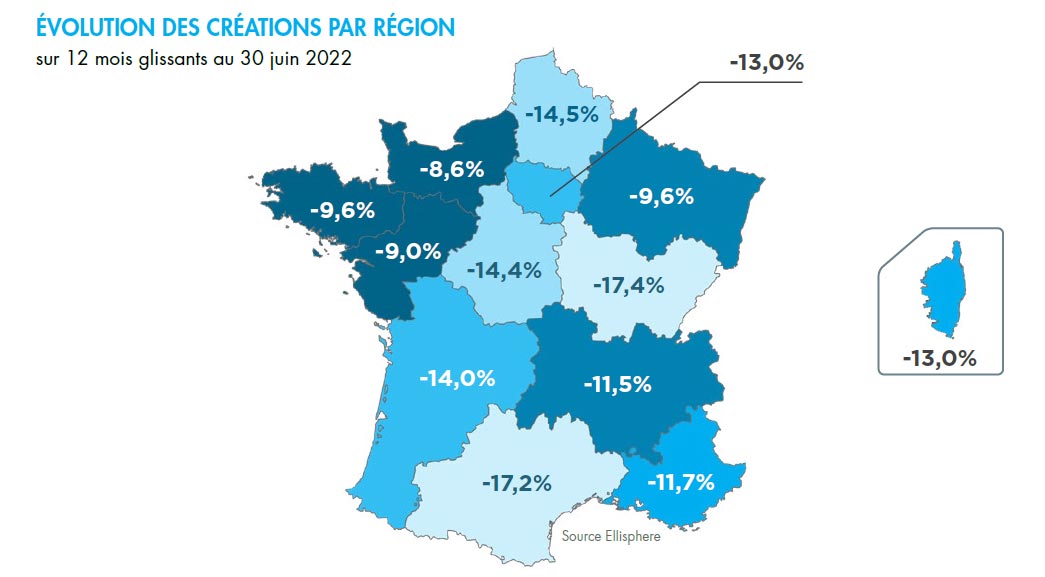

Construction: an important and still dynamic activity

With nearly 719,300 active companies, the Construction activity (public works, structural work and finishing work) accounts for 6.4% of the population of companies in metropolitan France, and 6.5% of the workforce for all activities combined. The activity remains relatively unconcentrated, with nearly 77% of VSEs and only 43% of revenues generated by companies with more than 50 employees.

Three segments are particularly important: general masonry work and building shells, electrical installation work for all premises, and painting and glazing work. These account for 41% of companies and 31.4% of employees in the construction sector.

Building materials: deterioration in business climate

With just over 34,000 active entities, i.e. 0.3% of the business population in mainland France, the number of companies in the Building Materials activity is lower than that of the Construction activity. As these activities are often multi-site (trading in particular), the territorial coverage remains significant with a total of 53,200 establishments in operation.

It is also a labor and sales activity with nearly 356,000 employees, or 1.6% of all employees in mainland France, all activities combined. In the regions, 51.2% of Building Materials companies are concentrated in Auvergne-Rhône-Alpes, Île-de-France, Occitania and New Aquitaine. As for the workforce in this activity, 45.8% are employed in the Hauts-de-France, Île-de-France and Auvergne-Rhône-Alpes regions.

The Building Materials activity is much more concentrated, with 64% of its sales generated by companies with more than 50 employees, including 43% by those with more than 250 employees. However, VSEs account for 63% of professionals. Numerically, it is the trade which weighs most, the wholesale trade of wood and building materials and retail in specialized stores represent 48% of the companies and 45.4% of the employees of the whole activity.

Download now our complete study

Every month, our Economic Unit deciphers the news of the economic sectors and gives you its lessons.