Pharmacy sector: a declining business population

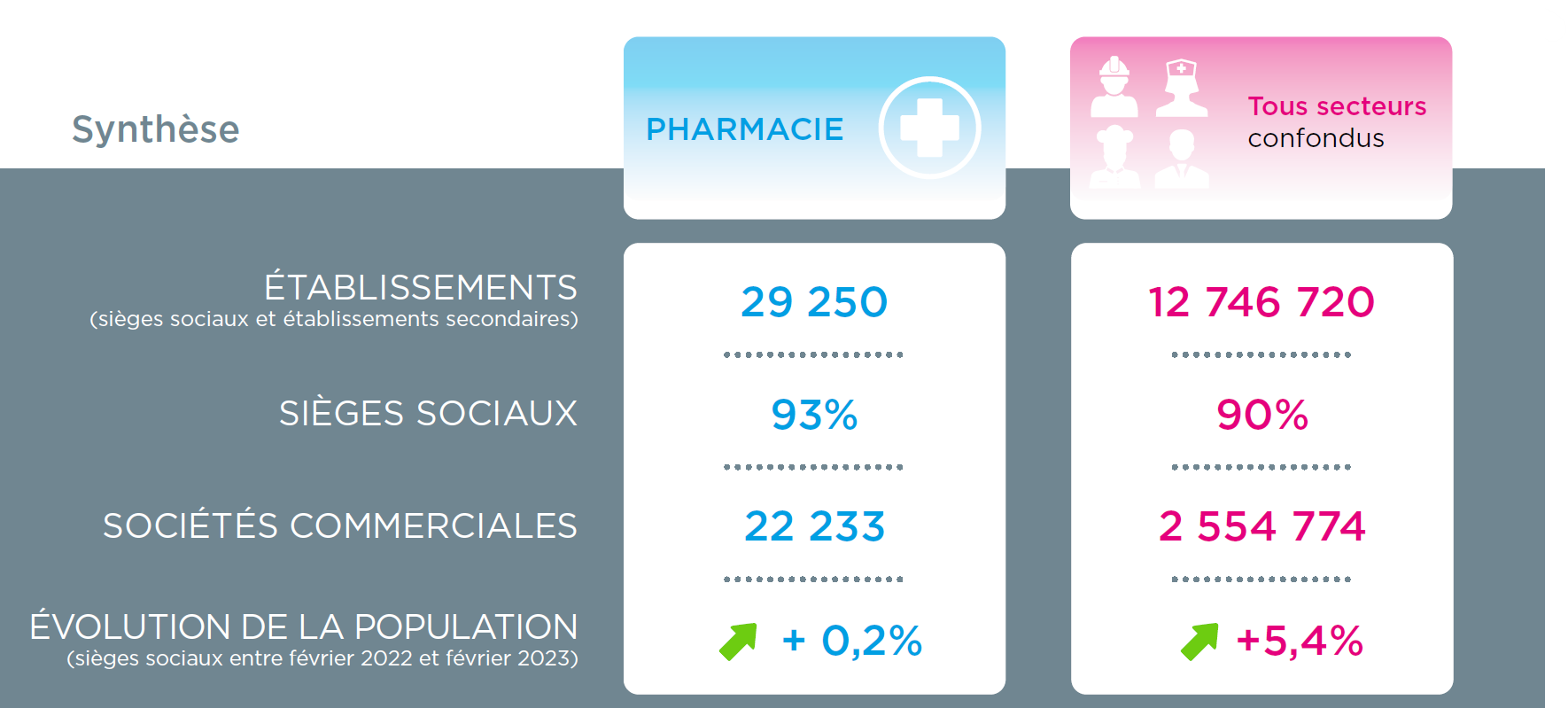

With just under 27,300 active companies and 249,000 employees, the Pharmaceutical sector has little weight within the metropolitan entrepreneurial population. It represents only 0.2% of companies for 1.1% of employees.

At the regional level, the business population is not very concentrated. While only one region, Île-de-France, accounts for 21.3% of entities and 37% of the national workforce, several other regions account for the other two-thirds: Auvergne-Rhône-Alpes, Hauts-de-France, Occitanie, Nouvelle-Aquitaine and PACA.

Numerically, distribution activities are the most important. Retail pharmacies account for 83.5% of companies and 40.5% of employees. In second place are wholesalers and distributors, which represent 13.4% of the sector's participants and 27.3% of employees.

Structural dynamism remains weak

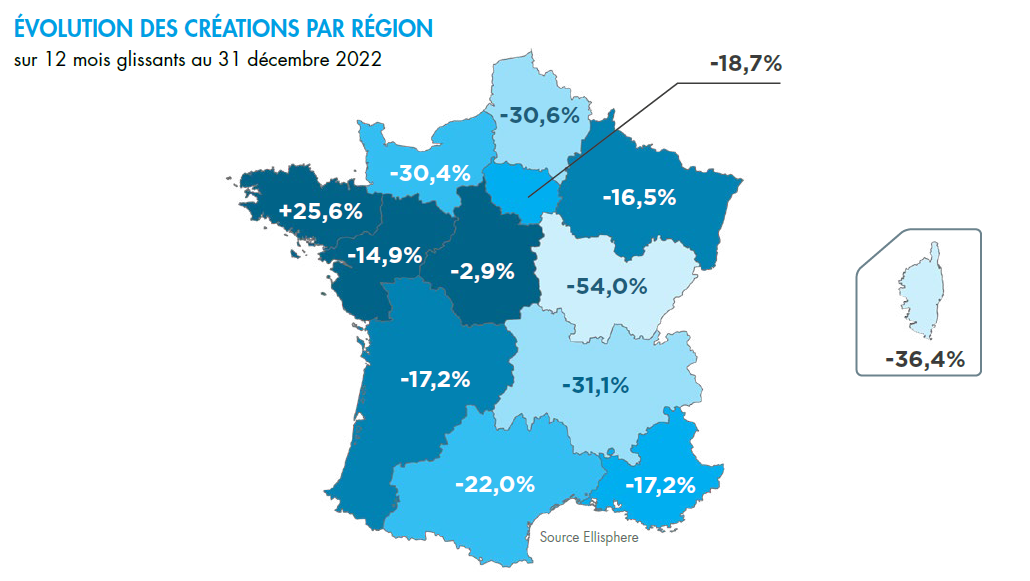

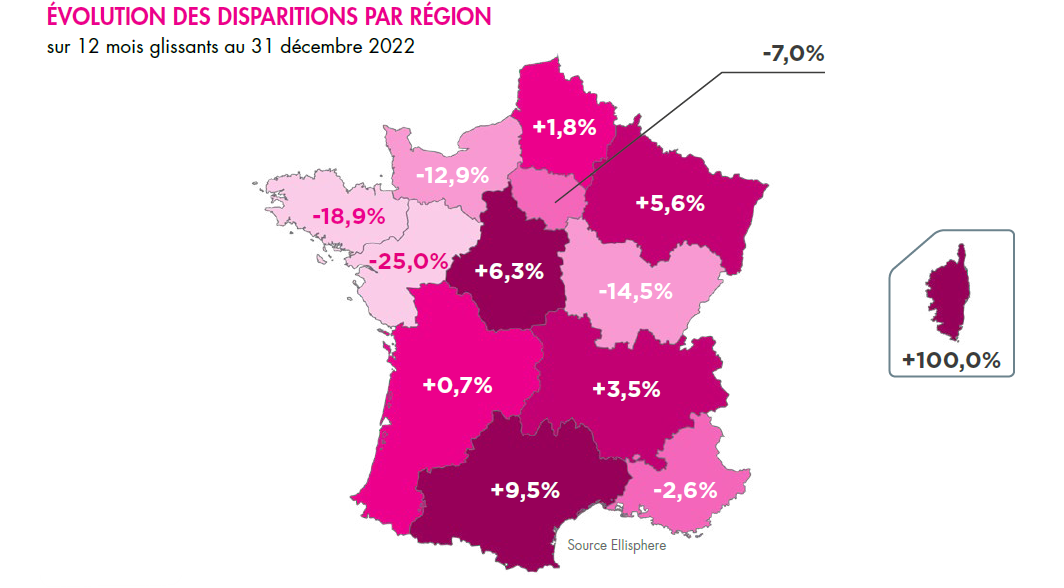

In the pharmaceutical sector, where industrial investment has been at half-mast for many years and where players are largely constrained by health regulations, dynamism is very limited. The population of active companies is growing very slowly, at less than +1% per year. Between January 2022 and January 2023, wholesalers and dispatchers grew the most at +1.5%. Unfortunately, since 2013, the sector has not been renewing its business population. In fact, more professionals are disappearing than being created. A situation that mainly affects retail pharmacies. The latter are suffering from low margins on drugs imposed by state management measures of health spending.

In practice, if operators cease their activities, the business is usually taken over by new groups or networks that seek to reach a critical size by maintaining the quorum of pharmacies based on the number of inhabitants. The opening of a pharmacy, by transfer or creation, is thus possible in municipalities with more than 2,500 inhabitants. The installation of new pharmacies is then authorized for each additional 4,500 inhabitants. After medical deserts, a phenomenon amplified by the demographic decline in certain regions, territorial inequalities are increasing in terms of access to pharmacies.

A low loss ratio

Since 2020, the number of insolvencies in the sector has remained very limited, with less than one hundred receivership or direct liquidation proceedings opened. However, the trend has been towards an increase in the number of insolvencies since 2021. Over the last 12 months, these procedures have mainly affected retail pharmacies, which account for 53% of judgments, a figure that has risen by 18%, as well as wholesalers and distributors, which account for 42.5% of judgments, up by 27.6%. Only four manufacturers were hit by a default.

"According to INSEE, in 2022, pharmaceutical production in France grew by +5.6% in volume and should remain well oriented in 2023. An important growth lever for manufacturers is the creation of biomedicines. To this end, the recently created France Biolead alliance (December 7, 2022) hopes to make up for the delay in our country in this area by federating the players, with the aim of doubling the production of biomedicines in France by 2030.

- Max Jammot - Head of the economic division at Ellisphere

Download our complete study now.

Download our complete study now.

Every month, our economic division decrypts the news of the economic sectors and gives you its lessons.