Cryptocurrency is a virtual currency that does not have a physical form

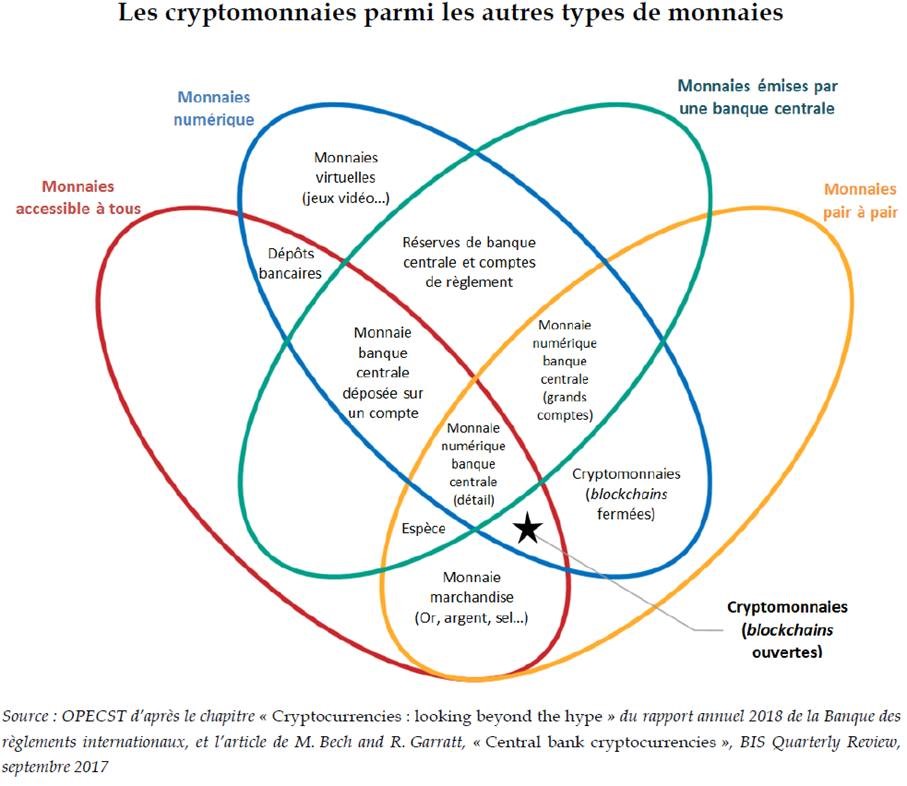

A cryptocurrency is a virtual digital currency using encryption technologies around a peer-to-peer payment system (see chart). Conceived in 2008 as an instrument of exchange in the digital world, it is based on a computer protocol of encrypted, decentralized transactions stored in a blockchain.

The blockchain is a transparent, secure information storage and transmission system. At the heart of decentralized finance, without a central control body, this technology brings security and transparency to transactions while ensuring the confidentiality and authenticity of exchanges, validated by miners. Thus, to confirm a transaction, a miner paid in tokens must find the product of a cryptographic function that connects a new block to its predecessor. This is called proof of work.

Through this process, crypto-currencies never leave the blockchain. They are just assigned to different wallets composed of at least two elements: the public address and the private key. But it can happen that some wallets add other identification elements. These virtual wallets are managed by "Exchanges" platform. The words coin and token are very common terms used in these digital exchanges to designate the different units of account of digital virtual money.

Characteristics of cryptocurrencies related to blockchain and cryptocurrency

Cryptocurrencies (Cryptos) called digital assets or cryptoassets are private money. They are characterized by an absence of physical support: neither coins nor banknotes. Unlike traditional currencies, they are only a digital proof of ownership, stored on a blockchain to transfer ownership of Cryptos between virtual currency users.

This is why they are considered as an alternative currency, without a trusted third party, to buy goods and services, to finance fundraising via ICOs (Initial Coin Offering) or to speculate via trading (buying and selling).

Popularized by bitcoin, there are now a large number of cryptocurrencies available around the world. Each one has its own characteristics and applications, ....

|

The world of cryptocurrencies is teeming - In early 2021, it is estimated that there will be nearly 8,500 cryptocurrencies |

|||

| Name of the cryptocurrency | Usage - | Classification | Number in circulation |

| Bitcoin (BTC) | Purchase of goods and services on the Internet or in real life. Unit of account BTC | Payment | 18.6 million |

| Ethereum (ETH). | designed for the establishment of smart contracts and decentralized applications | Infrastructure | 114 million |

| Ripple (XRP) | Real-time gross settlement system (RTGS) | Payment | 45.4 billion |

| Bitcoin Cash (BCH) | Used as a decentralized electronic payment system | Payment | 18.6 million |

| Litecoin (LTC) | Oldest currency of exchange | Payment | 66.3 million |

| Monero (XMR) | Allows for anonymous and confidential transactions. | Payment | |

| ... | |||

Role of cryptocurrency platforms and wallets

Investing in the world of cryptocurrencies purchase and/or exchange is done through an exchange platform called "Exchange". There are two types.

To buy crypto-currencies (Cryptos) with euros, dollars ... one uses buying platforms. On the other hand, to exchange crypto-currencies for other crypto-currencies you have to go through exchange platforms.

In both cases, it is necessary to have a wallet to store your Cryptos. In fact, there are four categories of wallets classified in two forms: hot and cold. Hot wallets are by definition online (cloud, software downloaded on a personal computer or smartphone) while coldwallets are physical wallets such as paper or USB type hardware.

Role of public and/or private keys

In portfolio management and purchasing/selling processes, there are public and/or private keys.

When a user wants to sell cryptocurrency units to another user, they must send them to the latter's virtual wallet. The transaction is considered complete only when it has been verified and added to the blockchain through a mining process. The public key is used to make payments to the recipient's wallet address, while the private key (root seed) is used to transfer cryptocurrency. The private key acts as a password for account access and the public key allows for public verification of the signature without the private key being revealed. Thus, it can be said that someone only really owns Cryptos when they have access to their private keys. A public key always goes hand in hand with a private key.

Dangers to be taken into account

It should be noted that hackers are constantly trying to steal cryptocurrencies from exchange platforms. This is why it is advisable to use a digital safe to avoid a risk of hacking and loss of funds.

The sector is moving every day towards more security, transparency, to lift the image and distrust of users towards cryptocurrencies strongly associated with criminal natures. It should be noted that registration on a cryptocurrency platform is not done in an anonymous way. Identity information is requested. These are the KYC procedures -Know Your Customer or customer knowledge management. In 2020, the criminal share of all cryptocurrency activities has decreased significantly and has fallen to 0.34% of the volume of transactions exchanged (Source Chainalysis).

Functions and uses of the platforms

Cryptocurrency platforms offer as standard the purchase and exchange of cryptos, complemented by portfolio management and storage. The calculation of fees for the purchase of crypto currencies is based on the volume of transactions and range from 0.01 to 0.5%, but can go up to 10% depending on the purchase medium (Card, bank transfer, PayPal, payment processor (Paxful, Koinal, Banxa, Simplex, ...), etc.. ).

Choosing a platform is based on criteria according to the activity that one wishes to have. The best known consumer platform is Coinbase. It made a record IPO on April 14, 2021 with an estimated record valuation of $86 billion on its first day. But its scope of activity is drawing suspicion from regulators, who are concerned about cryptocurrencies being used for illicit purposes.

In the logic of democratization of this virtual currency, PAYPAL since October 2020, gives its 300 million users the opportunity to buy, sell and keep cryptocurrencies directly in their digital wallet Paypal ;

These announcements allow us to envisage a certain and rapid popularization of virtual currencies by simplifying the complexity of acquiring them and in their use. Thus, recognized providers of mainstream financial services are beginning to take cryptocurrencies seriously and integrate them into their services. It is also known that asset management companies are investing large amounts in this currency to protect themselves from the loss of value of traditional currencies in an unstable economic climate due to Covid.

Some names of "Exchange" platforms specialized in cryptocurrency

| Name | Location | Buy/Exchange/Trade | Number of cryptocurrencies in portfolio |

| Coinbase | USA | Yes | 11 |

| Binance | Hong Kong, Japan, South Korea | Yes | 184 |

| Bitshares | Decentralized | Yes | 200+ |

| eToro - Europe | Registered in Cyprus | Yes | 16 |

| Paymium | France | YES | Bitcoin |

| .... |