An increase in prices for the Agriculture and Fishing sector... but not in volumes

In November 2022, the report of the Inspection Générale des Finances mentioned food inflation and pointed out the origins of these increases: war in Ukraine, post-Covid recovery, weather conditions related to climate change, animal health crises, economic factors (rising energy prices, loss of competitiveness of French agriculture, labor shortage in particular).

In 2022, the rise in prices, despite a quasi-stability of production in volume, favored an average increase in agricultural production in value. The latter is mainly driven by the increase in the value of wine and cereal production and by that of animal production.

For the fishing industry, fish stocks remain tightly controlled by quotas. Prices have been caught up by inflation under the cumulative effect of these quotas and the increase in fuel and energy prices more generally. France, which has obtained only 1,054 fishing licenses from the United Kingdom and the Channel Islands, has initiated a plan to exit the fleet, which could concern more than a hundred vessels whose home ports are in Brittany, Normandy and Hauts-de-France.

The agricultural sector dominated by cereal activities

The Agriculture and Fishing sector has nearly 697,200 active entities, i.e. 6.1% of companies and 1.6% of employees (346,400 jobs) in all activities in metropolitan France. Nearly 672,300 companies are in the Agriculture branch alone, i.e. 96.4% of those involved for 68.3% of the workforce of the entire sector. This branch is mainly composed of cereal growing (22%), vineyards (17%) and cattle breeding for meat (11.5%).

In second place, far behind, are agricultural product trading activities, representing 1.8% of companies for 27% of the workforce in the entire agriculture and fisheries sector, with a preponderance of companies in the wholesale of fruit and vegetables (35%), cereals, seeds and tobacco (19.7%) and live animals (19%).

In 20 years, France has gone from 2nd to 5th place in the world exporters of agricultural products ... This decline is worrying. For its part, fishing accumulates difficult periods related in recent years to the consequences of Brexit and the decline in fish sales during the health crisis. Finally, the explosion of energy prices (especially diesel) has further weakened the financial situation of fishermen and farmers.

- Max Jammot, Head of the Economic Division at Ellisphere

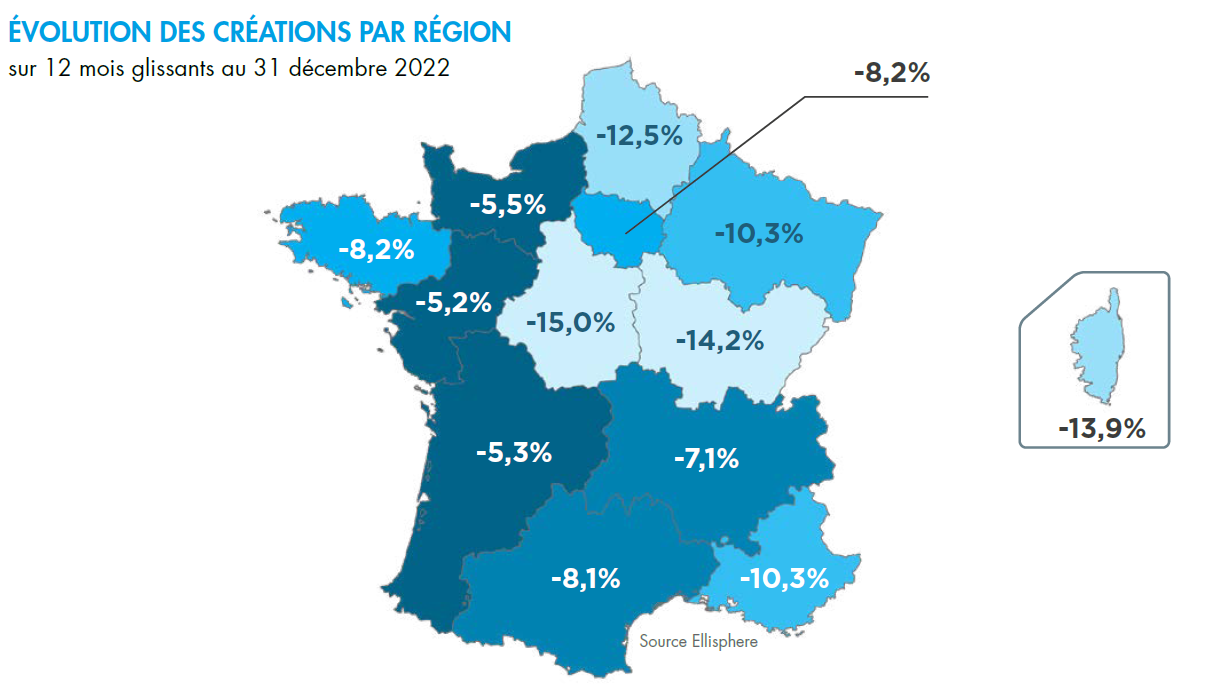

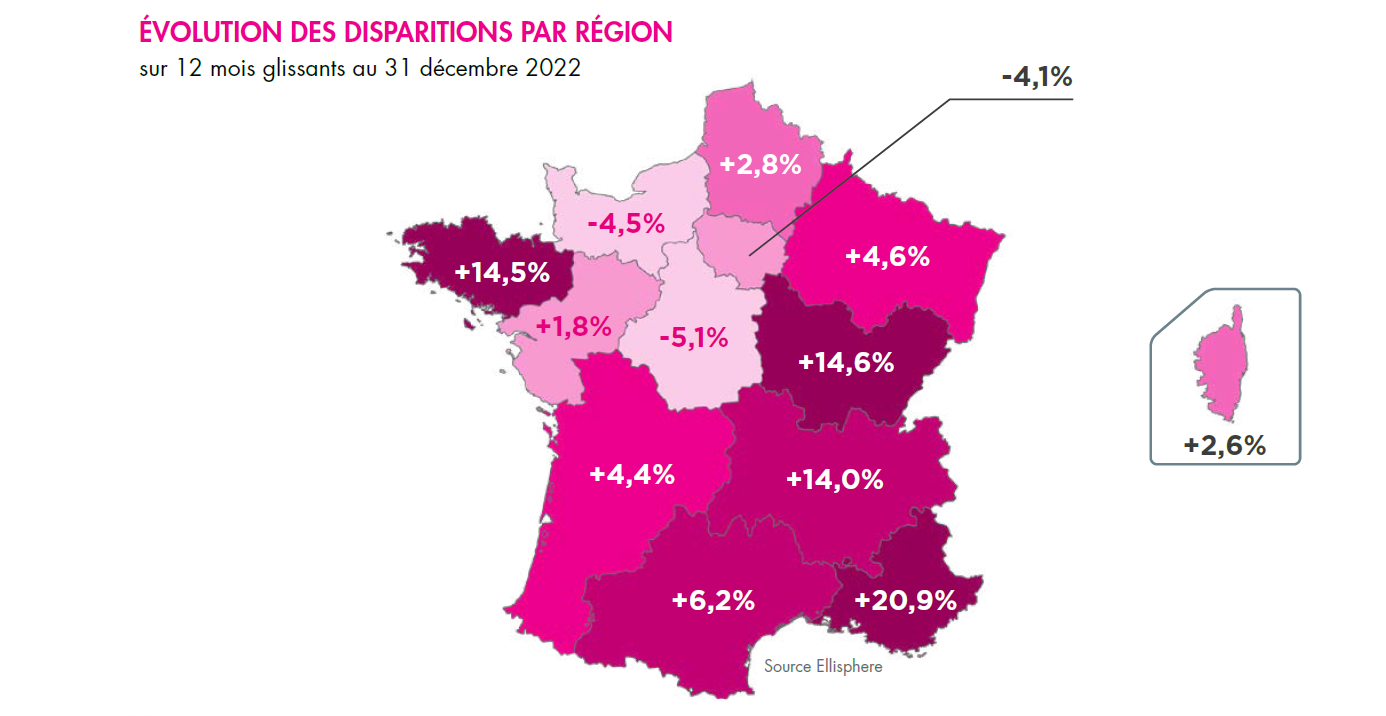

Very disparate company creations and disappearances

The sector's dynamism is weak. Between January 2022 and January 2023, the number of companies considered active grew by only +1.6%, compared to the +5.4% growth in mainland France for all activities combined. Over the period studied, the agricultural products trading sector was the most active (+3% of active companies), while the fishing sector grew by only +0.9%. In the regions, Île-de-France, Corsica and PACA were the most active with growth in the population of companies close to +3%.

Ellisphere's Entrepreneurial Dynamism Index* confirms the sluggishness that is taking hold in the Agriculture and Fishing sector. Indeed, since 2012, this sector has been struggling to renew its business population. The average growth in business start-ups has remained low (+1%) while the number of business closures has increased significantly (+1.1%).

In 2022, however, the number of claims in the agriculture and fishing sector was limited, with cessation of activity remaining the main cause of business disappearances. Thus, at the end of 2022, only 3.1% of business disappearances in the sector were due to judicial liquidation, well below the national average for all activities combined (5.8%).

*Indice of Entrepreneurial Dynamism (IDE): it is the ratio between the total number of creations and the total number of disappearances of company on a sector of activity, a geographical zone...

Download now our complete study.

Every month, our economic division decrypts the news of the economic sectors and gives you its lessons.