A sector in turmoil

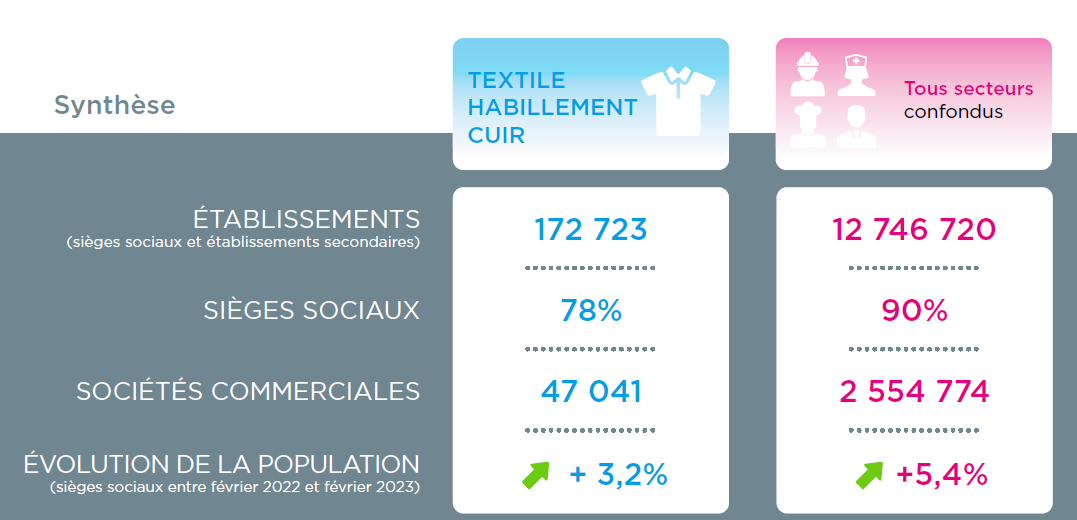

In March 2023, the Textile-Apparel-Leather sector has nearly 173,000 active companies, or 1.2% of economic actors in metropolitan France. The sector employs 315,000 employees, or 1.4% of the national workforce. In the entire sector, clothing activities, from clothing to retail, represent 79% of companies for 71.7% of employees.

Next come textile production and trading activities, with around 16% of active companies and employees. Leather activities close the gap with 5% of active companies in the sector and 11.8% of employees. The entrepreneurial population of the Textile-Apparel-Leather sector has been increasing little for several years.

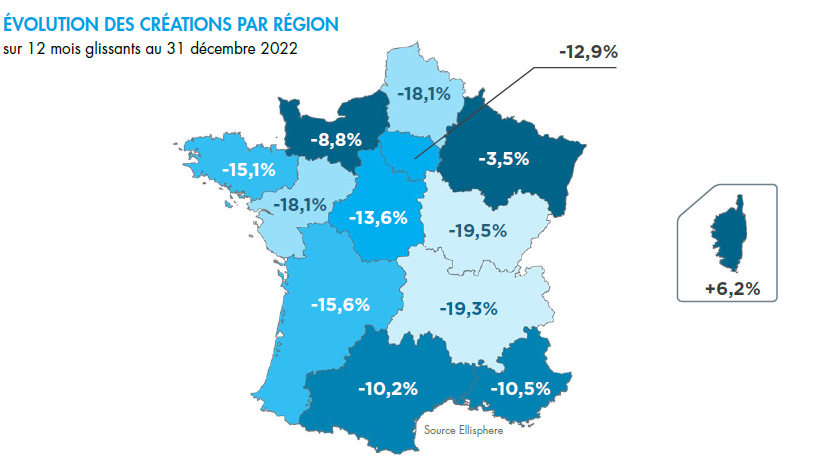

Although clothing has made little progress, it nevertheless remains the leading source of new structures for the sector as a whole, accounting for 77% of business creations, but also for most business closures (83%). Two activities stand out in particular: retail in specialized stores with 23% of creations, and retail on stalls and markets with 13% of business creations in the sector.

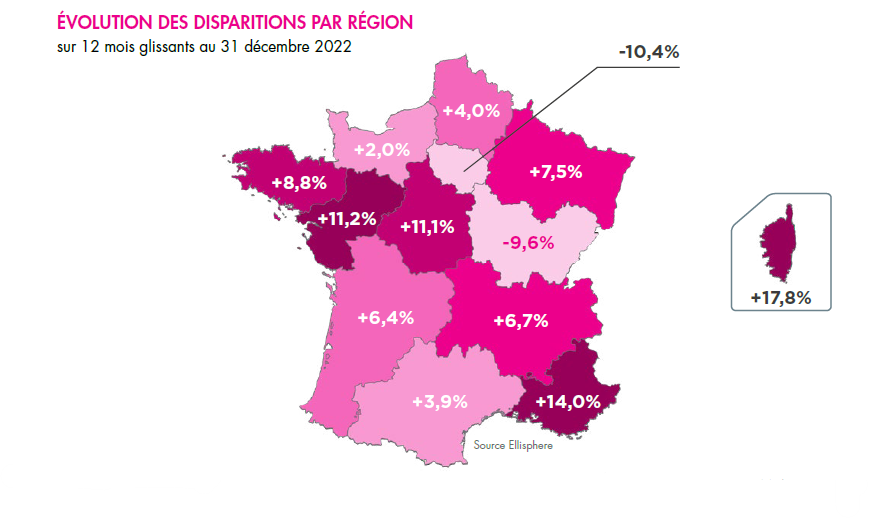

As a result of the current difficulties in the sector, the number of business disappearances has exploded in these two activities, to the point of representing 54% of business disappearances in the sector. In 2021, these activities recorded an increase in the number of business disappearances, respectively +15% and +67.4%. For retail stores, the loss ratio rises sharply in 2022, a year in which 13% of the losses were the result of judicial liquidation.

"It is clear that when certain structures take on a high level of debt, devoting a good portion of profits to its repayment is necessary... It is also appropriate to question the future of the positioning of the mid-range between a low-cost that is gaining market share and a high-end that is consolidating its customer base."

- Max Jammot, Head of the economic division at Ellisphere

Mid-range ready-to-wear in great difficulty

This segment, which is very present via physical stores in cities or shopping malls, has often not been able or has not been able to make the shift to online sales (one fifth of clothing sales in 2021). Moreover, their range positioning is increasingly difficult to maintain in the face of low-cost or fast-fashion online chains, as well as a more upmarket-luxury offer that attracts and retains customers in stores.

If the crisis of the sector has been latent for several decades, the Covid-19 pandemic has had a violent impact on the entire production and distribution chain, which is largely globalized. Asian manufacturing countries, led by China, were the first victims of the health crisis, blocking the entire supply chain. The textile industry has suffered enormously...

In 2020, referenced as "non-essential" businesses at the time of the first containment, the majority of the stores were closed... While having, for the most part, to continue to honor the rents. The deleterious impact on cash flow was immediate and unfortunately often fatal.

Over the period 2021-2022, in the middle of Covid-19, the postponement of orders on internet purchases has actually accelerated at the expense of stores, shunned by the French in 2022; 15% fewer customers in physical stores compared to 2019.

Collective proceedings on the rise again

In this context, many brands, whose situation has long been precarious, are no longer able to withstand the difficulties that persist. It is not surprising that the number of business failures in the sector over the last 12 months to the end of February 2023 has risen by 56%!

Nearly 87% of these insolvencies concerned clothing, of which nearly 54% were in the retail clothing sector alone, an increase of 65.4% over one year. The footwear market is also suffering. Although it accounts for slightly less than 10% of insolvencies, the number of insolvencies has increased by nearly 70% in the footwear retail sector alone.

Download our complete study now.

Every month, our economic division deciphers the latest news in the economic sectors and provides you with its findings through the Eco Focus.