Since January 1, 2016, in accordance with Article A123-96 of the Commercial Code, any individual may request, when completing the formalities for creation or modification, that the information in the INSEE Sirene directory concerning him or her not be disseminated to third parties, other than the administration.

Our study is therefore based on the available and disseminable data from the Sirene directory, which is available in the Ellisphere data repository.

What is the methodology for this study?

The data used in this regional economic environment study were extracted from the Ellisphere database on January 24, 2022.

This study considers entities registered with SIREN and NIC in metropolitan France whose activity and legal form are known on the extraction date. The Ellisphere repository provides economic, legal and financial information on nearly 16.8 million French entities up to 10 years after their termination date.

What is the profile of the entities studied?

The address of the head office, the APE/NAF code, the year of creation, cessation or judicial liquidation, the number of employees, the elements of the published and available social or consolidated balance sheets including the turnover and the total balance sheet.

These profile elements are aggregated and reported by geographic, sector, legal form or company size criteria.

Glossary

Creations: the counting of creations takes into account all legal entities for which the initial date of registration with the clerk's office or that declared to INSEE is known.

Disappearances: the counting of disappearances takes into account all legal entities whose date of cessation of activity is known, whether it is a cessation outside of collective proceedings or a judicial liquidation.

Loss rate: when the disappearance is the result of a judicial liquidation, it is sub-categorized to calculate the loss rate (ratio between the number of liquidations and the total number of disappearances).

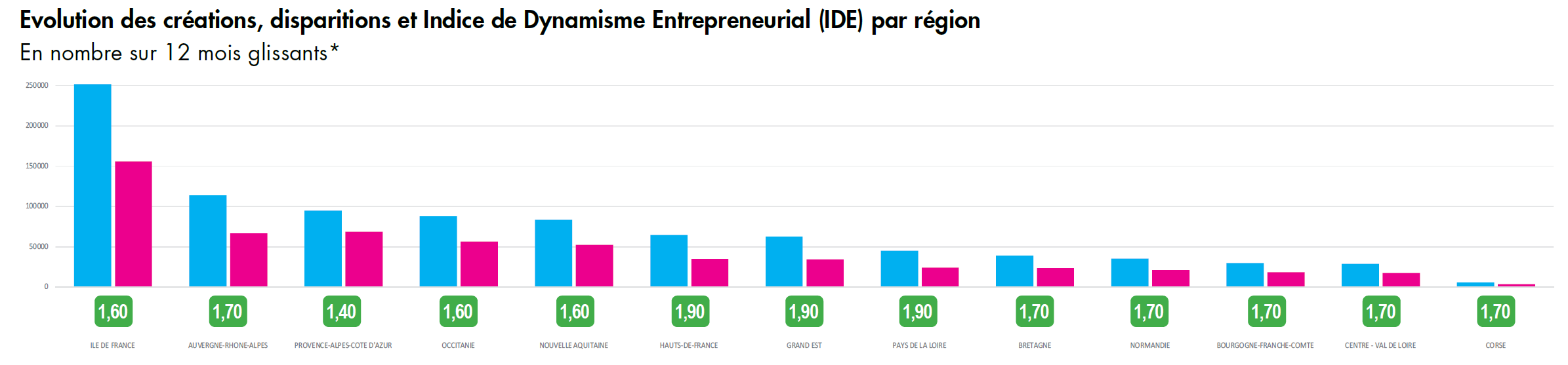

Index of Entrepreneurial Dynamism (IDE): it is the ratio between the total number of business creations and the total number of business disappearances on a sector of activity, a geographical area...

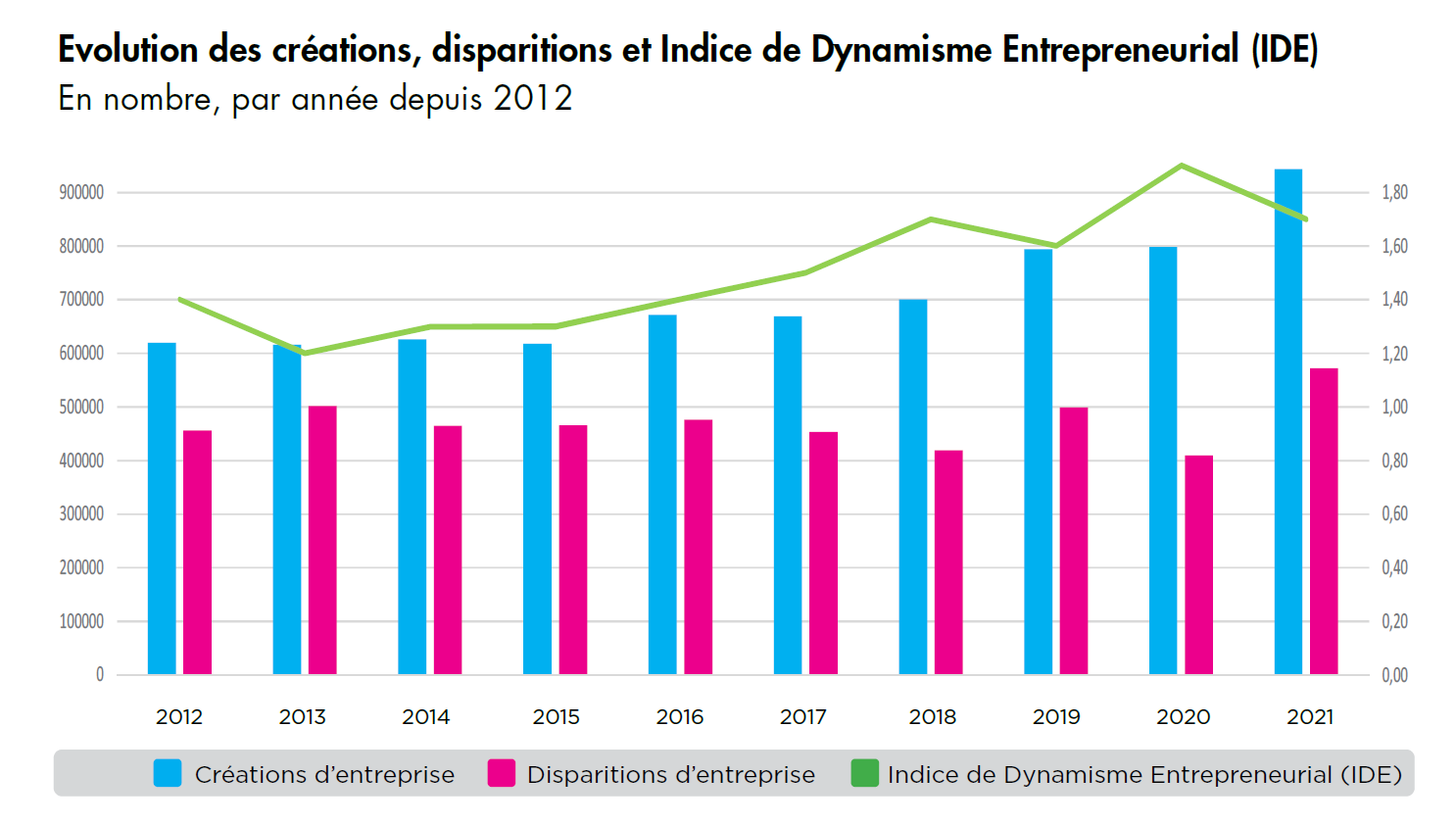

A still dynamic population

Between the beginning of 2012 and the end of 2021, the population of French companies in metropolitan France has remained dynamic. It has continued to grow and renew itself. Over the period, nearly 7.1 million entities of all legal forms were created, while 4.7 million disappeared. On average, 1.5 new entities were created for every one that disappeared over the last 10 years. Moreover, the loss ratio (share of liquidations in disappearances) remained stable at around 11% between 2012 and 2018, before beginning a cyclical decline in 2019, then a more artificial one in 2020-2021 (exceptional government measures).

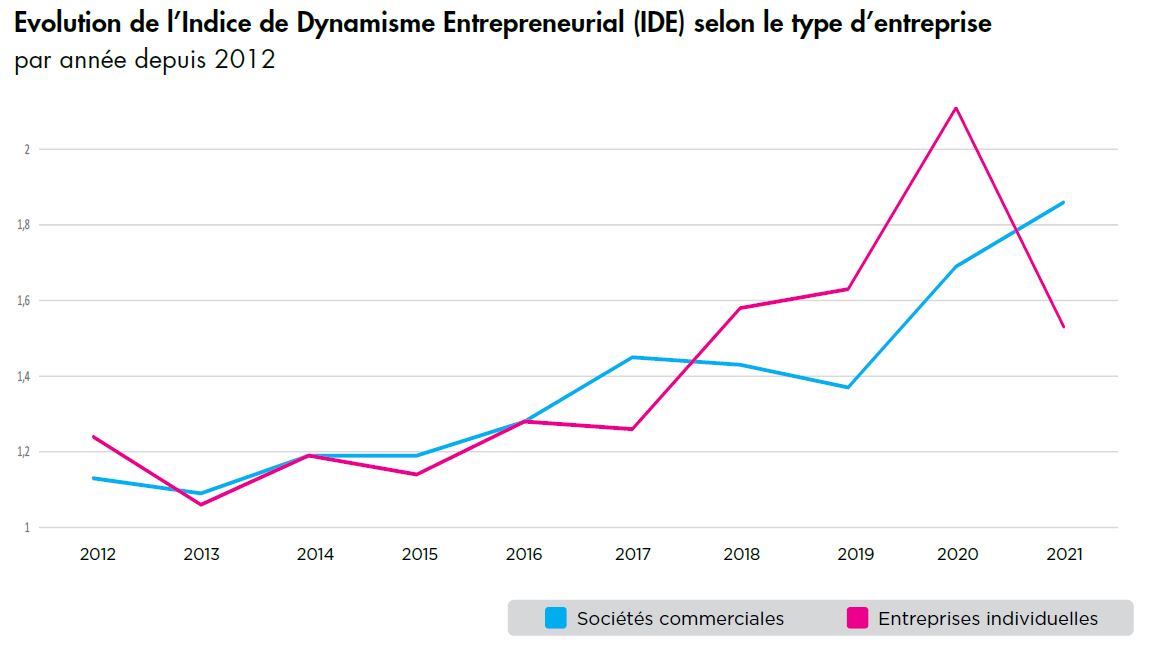

Over the period studied, other variations appear. First of all, it should be recalled that in response to the economic crisis of 2008, the government of the time created the status of auto-entrepreneur, which became micro-entrepreneur** in 2016 - a simplified status of the legal form "Individual Enterprise". This special status was very successful in a context of deterioration of salaried employment, and uberization of the world of work. In 2009, according to INSEE, the number of business creations reached a first record level of 580,200 creations, i.e. 75% more than in 2008. Since then, and in spite of a growing legal, regulatory, social and fiscal framework, its success has not been denied and remains very significant in the volumes of business creations and terminations.

** The micro-enterprise is a sole proprietorship with a reduced tax and social security regime.

Overall, the deleterious effects of the 2008 global financial crisis on the dynamism of the French entrepreneurial fabric lasted until 2015. Until that date, the number of new businesses created remained relatively stable each year, at around 620,000 new entities. Faced with these creations, 472,300 terminations of all legal forms were recorded, with a high level of judicial liquidations (53,900 per year), i.e. 11% of the disappearances.

As of 2016, the economic situation has improved. Financial institutions began to loosen the stranglehold on access to credit. As a result, the number of new businesses has resumed an upward curve, still essentially driven by individual entrepreneurship, including micro-businesses.

For their part, terminations have evolved more erratically. A significant increase was noted in 2013, most probably linked to the strong increase in social security contributions for self-employed entrepreneurs, who were more likely to throw in the towel.

After a decline over the 2017-2018 period, the number of terminations has risen sharply in 2019; a spike linked again, in part, to more restrictive obligations for auto-entrepreneurs (obligation to declare turnover online, withholding tax...), but also to the recovery of salaried activity in a more favorable economic context.

It is also necessary to take into account the automatic cancellation of micro-enterprises that have not declared any sales for 8 consecutive quarters or 24 months. According to INSEE, on average, only one third of those registered as micro-enterprises are still active three years after the date of creation.

"While the government is rightly pleased with the high level of business start-ups and the renewed attractiveness of France, it must be borne in mind that this increase in start-ups is essentially due to micro-entrepreneurs, whose simplified system has attracted a good number of people: exemption from VAT (provided certain thresholds are not exceeded), partial relief from social security charges during the first year of activity, etc."

- Max Jammot Head of the economic research department at Ellisphere

Fiscal year 2020 has of course been marked by the arrival of Covid, which has revived the creation of individual businesses in a difficult context for the workforce; while at the same time, the broad state and bank support has prolonged the existence of many businesses, thus limiting the number of terminations due to windfall effects.

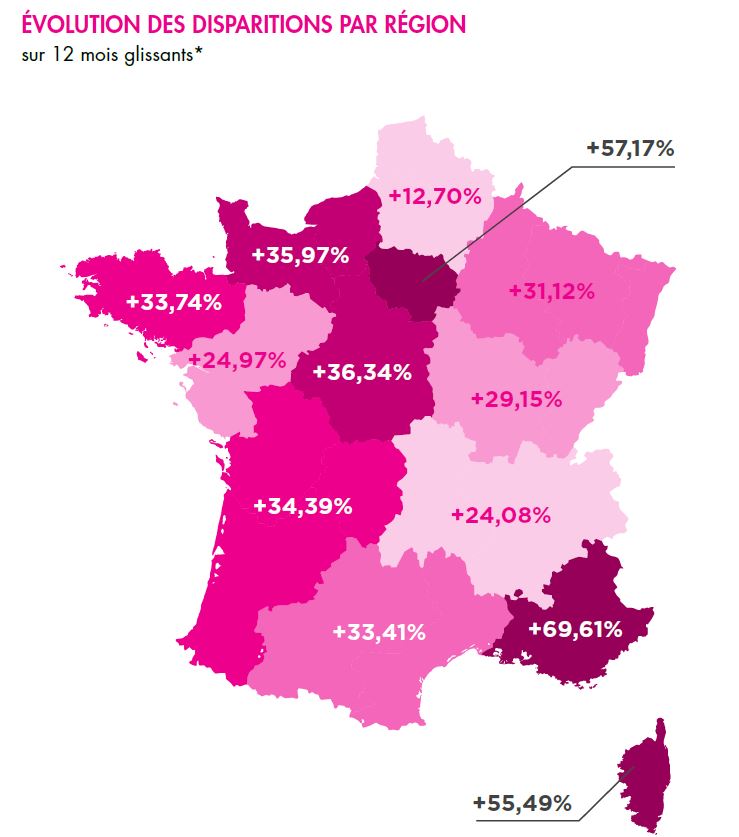

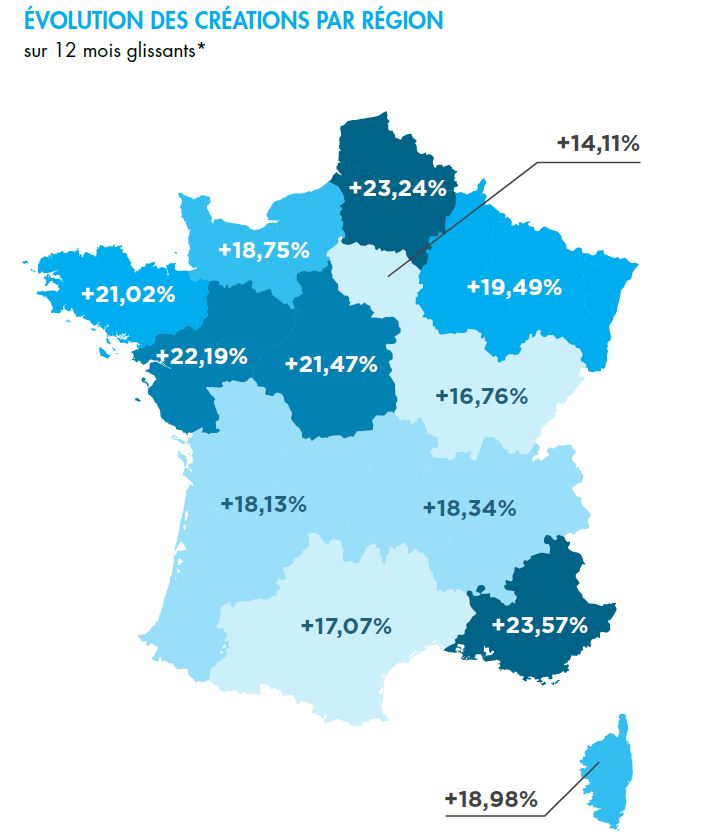

In 2020, almost two companies were created for every one that disappeared. In 2021, creations reach a record of more than 943,000 new entities, and at the same time the number of terminations explodes with +40%. For the latter, this result can be explained by a crisis that is dragging on, and a financial situation that has become delicate in the face of a gradual reduction in aid, the expiry of the repayment of loans guaranteed by the State (PGE), as well as the regularization of tax and social contributions.

Stable level of fund sales and purchases but shaken by the Covid crisis

Over the decade studied, an average of 3% of the creations were not ex nihilo but were total or partial takeovers of existing activities. 94% were classic purchases of funds and 5% were contributions of funds. The latter solution is often adopted by individual entrepreneurs to move towards a legal form as a commercial company (SARL or other) in order to perpetuate and transmit the business.

On the other hand, over the same period, an average of 5% of the disappearances did not mark the definitive cessation of the business but their transfer to another existing entity or one created for the occasion. 63.2% were the result of a traditional sale of the business to another operator and 36.6% were mergers and acquisitions, 64% of which were in the form of a universal transfer of assets (TUP), a legal operation in which a company that holds 100% of the share capital of a subsidiary absorbs and dissolves it.

The emergence of the Covid crisis has put a brake on business transactions in 2020 with - 30% of business takeovers in creations and - 21% of business contributions for disappearances. These decreases can be explained by several concomitant factors, firstly by a slowdown in the activity of operations at the registries, secondly by a reluctance on the part of owners to put their businesses up for sale in this difficult period, and finally by a lesser appetite and a tightening of credit for potential buyers.

In 2021, fund takeovers in creations are back on the rise, but are still below the levels seen before 2019. Meanwhile, sales of funds in disappearances are still declining.