Organizational advantages: ee-invoicing and e-reporting e-reporting for improved control and successful pre-filling of VAT returns

One of the aims of the widespread use of electronic invoicing is to combat VAT and corporation tax fraud, by offering companies the option of pre-filling their VAT returns.

Today, we're talking about a VAT return, a Value Added Tax that represents the sum of VAT collected on sales, minus the sum of deductible VAT on purchases. It's a declarative tax that can be subject to fraud or, more simply, error.

In future, eligible companies will be able to submit all their electronic invoicing on dedicated, certified platforms. They will provide additional information via E-reporting. The tax authorities will then be able to verify, check and propose pre-filling of declarations.

- The role of electronic invoicing in BtoB is to deposit invoices on dedicated platforms. Two types of information are transmitted to the tax authorities:

- Certain information extracted from the invoice: supplier and customer identification, transaction amount excluding VAT, VAT due, VAT rate applied, etc.

- Payment data for all operations.

- The role of e-reporting is to transmit transaction data not covered by an electronic invoice to the authorities.

E-reporting is the transmission to the tax authorities of certain information (transaction amount, invoiced VAT amount, etc.) relating to commercial transactions not covered by electronic invoicing. These include sales and service transactions with private individuals ("business to consumer", BtoC) and transactions with foreign operators (exports, intra-Community deliveries). E-reporting makes it possible to reconstruct a company's overall economic activity, complementing electronic invoicing. Eventually, it will enable companies to pre-fill their VAT returns.

Note on intermediary platforms:

- The Chorus Pro public invoicing portal (currently used for transactions with the State or local authorities) (PPF)

- Partner dematerialization platform registered with the French tax authorities (PDP)

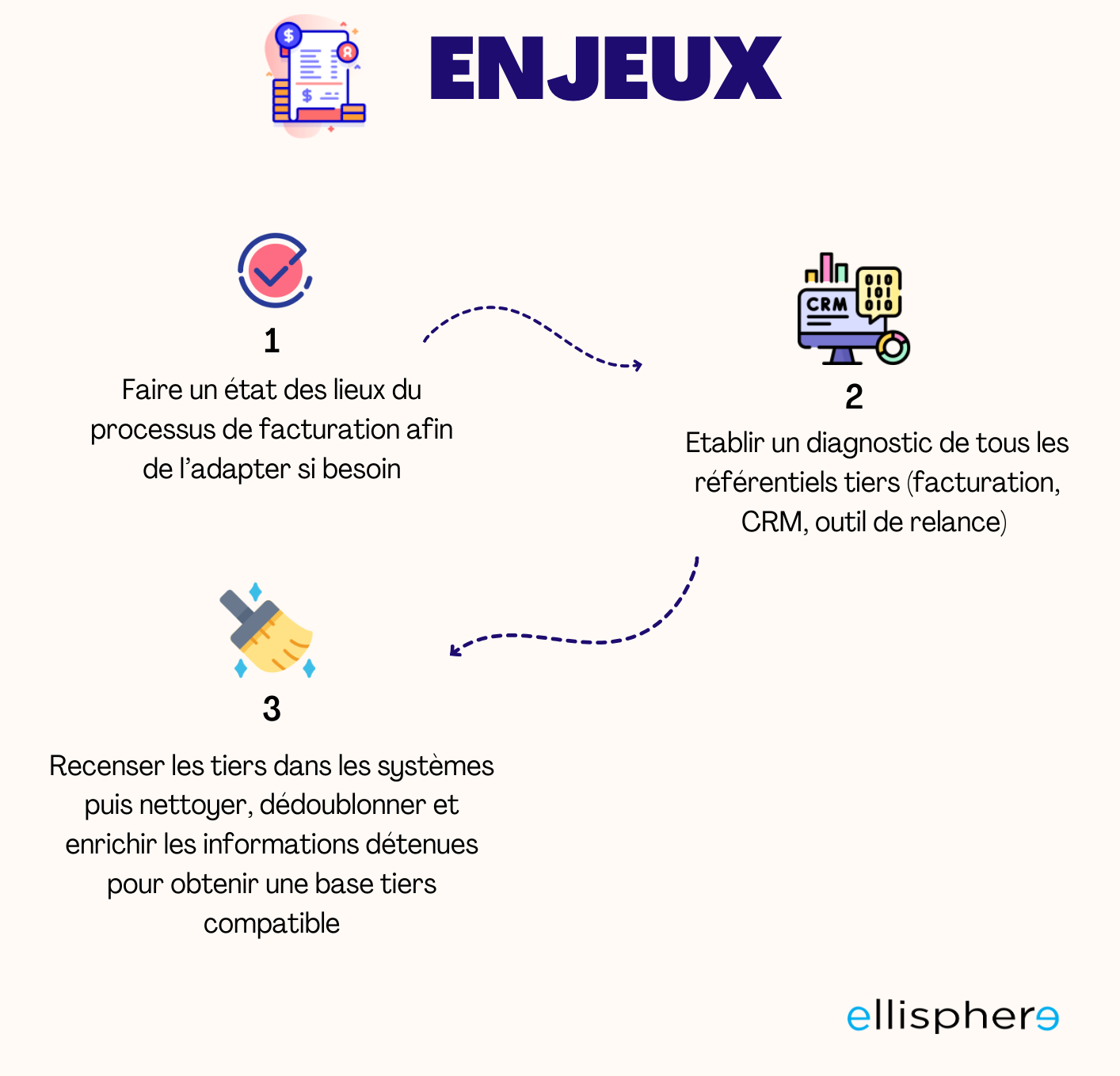

Support needed to make third-party information more reliable

- Challenges to meet

To ensure the successful deployment of electronic invoicing, eligible companies will need to systematically qualify and enhance the reliability of their customer and supplier information. Depending on their volume and the quality of their repository, they will need to be supported by experts.

Companies should therefore be supported as early as possible to :

- Clean up their repository so as not to keep third parties inactive unnecessarily,

- Deduplicate to facilitate information matching (invoices/repository) and increase efficiency

- Enrich data and make it more reliable, as new information will need to be added to invoices: SIREN number, intra-Community VAT number, delivery address when different from the customer's address, information as to whether transactions consist exclusively of the supply of goods, the supply of services, or both, and payment of VAT on the basis of debits, when the service provider has opted for this option.