A sector shaken by the crisis

For several years now, the retail sector has been suffering from a difficult economic context and a restrictive regulatory environment. In the retail sector, the erosion of the business model and its lack of openness have contributed to the advent of staff-saving measures and the success of "low-cost" stores. On the ground, adjustments are taking place. The Casino group, in financial difficulty, is selling off its businesses to the Intermarché group, while Carrefour is announcing a reduction of 1,000 salaried positions at various sites. For many small retailers, the explosion of Internet sales, home delivery and the arrival of new category-killers are making business more difficult. The recent Covid-19 crisis, with the forced closure of non-food retail outlets, has dried up many treasuries artificially supported by state-guaranteed loans that now have to be repaid.

"For some time now, we've been witnessing a shift in strategy, clearly embraced by the major retailers: in addition to the advent of "low cost" and an increased presence of "first price" products, these chains are focusing on proximity, and are gradually returning to town centers (mini-markets), which they had abandoned in favor of hypermarkets on the outskirts of towns."

- Max Jammot , Ellisphere Business Unit Manager

A heavyweight sector

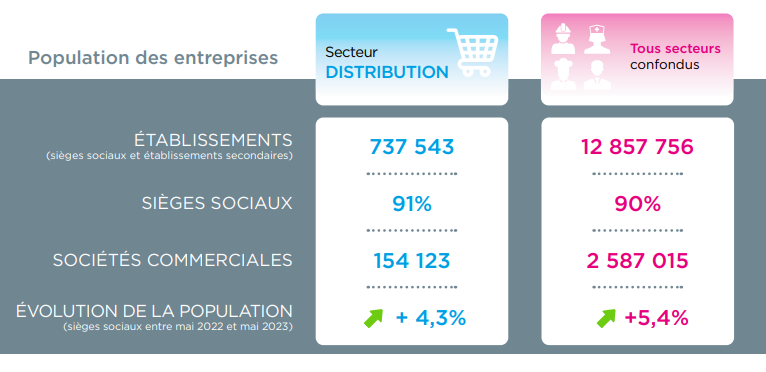

The Distribution sector studied here comprises almost 670,000 active companies, representing 5.8% of the entrepreneurial population in metropolitan France, and 4.5% of the workforce. This sector is dominated by non-food retailing (85% of companies for 27.4% of employees), represented mainly by home-based sales, which account for almost 30% of the sector's operators, boosted in particular by auto-entrepreneurship since 2008. Door-to-door sales, however, have been shaken by the rise of the Internet, with remote sellers selling specialized or general catalogs. This is followed by food retailing (13% of companies in the sector for 13.8% of employees), and finally general mass retailing, from mini-markets tohypermarkets, which, while representing only 2% of companies, employs 59% of employees in the Distribution sector.

A dynamism that remains good, but is losing speed

Between January 2022 and January 2023, the population of companies active in Distribution grew by +4.3%, slightly below the +5.4% recorded in metropolitan France for all sectors combined. During the Covid-19 pandemic, however, the Distribution sector recorded a peak between 2020 and 2021, with +11.4% business growth. Indeed, this period was deemed propitious by many to launch their own small businesses to supplement their salaries, or to change career direction.

A sharp rise in claims

At the end of May 2023, over a sliding 12-month period, the number of insolvencies in the Retail sector was back to pre-Covid-19 crisis levels, and even higher than in 2019. Over one year, with almost 4,000 receiverships or direct judicial liquidations opened, the number of insolvency proceedings has risen by 59%! Threatening nearly 11,000 salaried positions. The sector accounts for 8.5% of insolvencies and 6.6% of the workforce threatened by these procedures in mainland France, all activities combined. The biggest increase in the number of insolvencies was in food retailing, where the number of procedures rose by 66%. The main victims of these insolvencies are general food retailers, accounting for 17.6% of collective procedures in the sector, up 60.7% year-on-year. Retail butchers follow, accounting for 10.8% of insolvencies in the sector (+58.4% over 12 months to end May 2023).

Download our complete study now.

Every month, our economic division decrypts the news of the economic sectors and gives you its lessons.